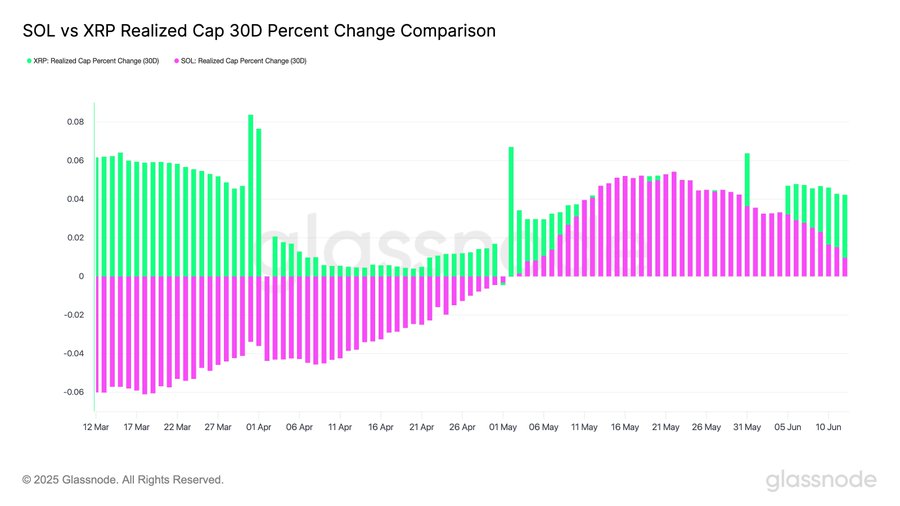

- XRP’s Realized Cap jumped 4.2% in 30 days, outpacing Solana and reflecting renewed capital inflow.

- Futures volume dropped while options volume surged, showing speculative interest but weak long-term conviction.

Over the last 30 days, Ripple’s [XRP] Realized Cap surged by 4.2%, far outpacing Solana’s [SOL] modest 1% gain.

This rise in realized capitalization suggests that capital is shifting more aggressively into XRP, a sign of increasing investor confidence and short-term conviction.

Since Realized Cap reflects the value of coins at their last movement, the uptick hinted at fresh bullish positioning from investors.

Therefore, this inflow momentum could be a prelude to stronger price action if market conditions remain favorable and buying pressure sustains above key support zones.

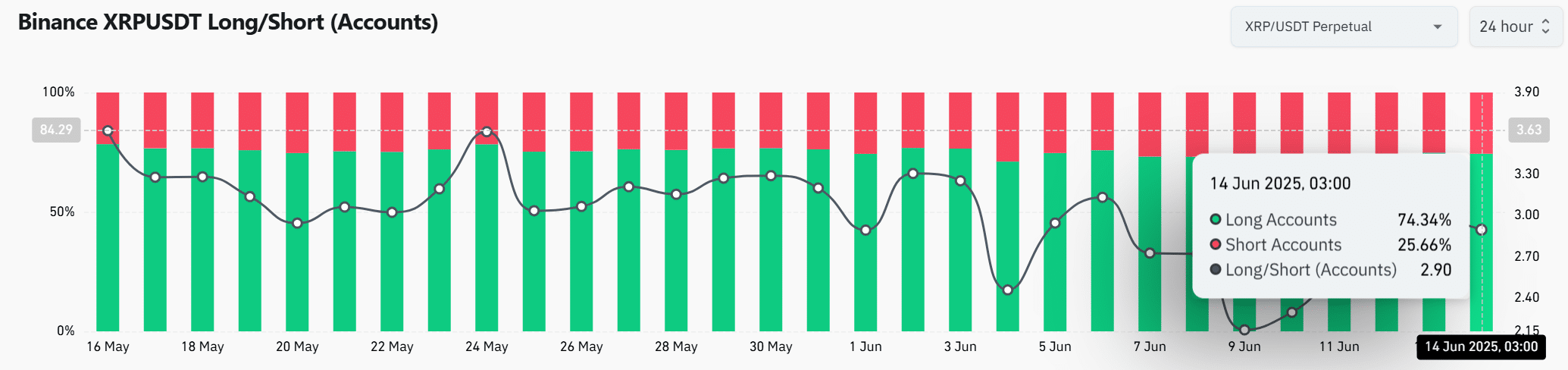

Are traders still favoring longs despite market uncertainty?

On Binance, 74.34% of XRP traders remained long as of the 14th of June, while 25.66% held shorts. That set the Long/Short Ratio at 2.90.

However, the steady decline in long dominance between mid-May and early June warns of creeping uncertainty.

Even though the ratio has started to recover, traders must remain cautious, as over-leveraged longs in a volatile market can trigger sharp corrections.

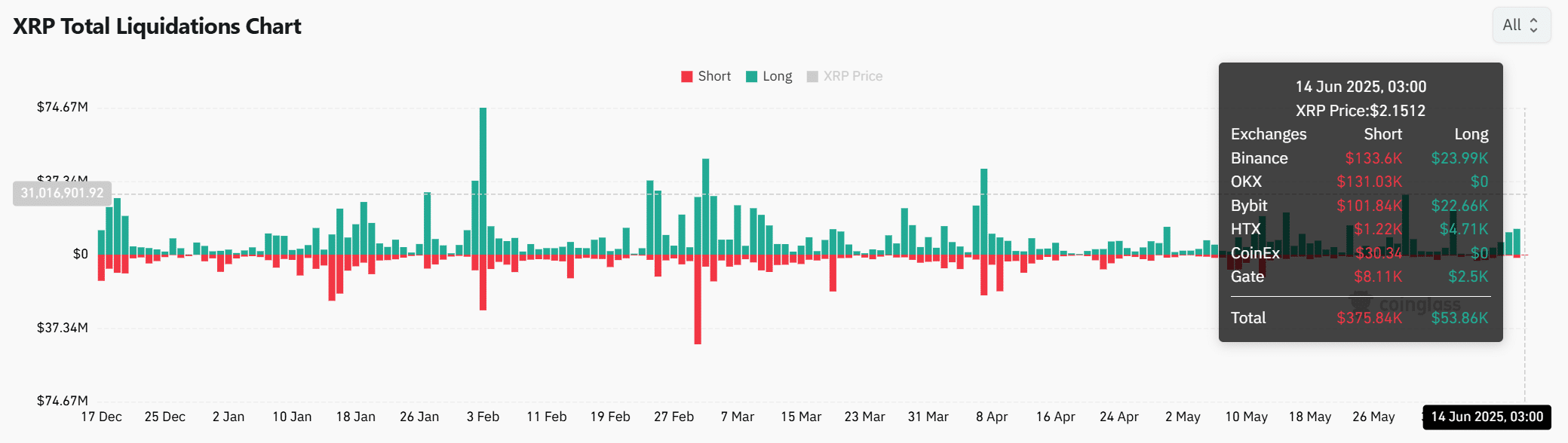

Is the short squeeze pressure building under the surface?

Meanwhile, XRP’s Liquidation Map flashed an early warning. Short traders took a $375.8K hit on 14 June—seven times larger than long liquidations.

The largest short losses occurred on Binance and OKX, suggesting that traders betting against XRP faced sudden reversals.

If these conditions persist, short squeezes could add fuel to upward moves in the coming sessions.

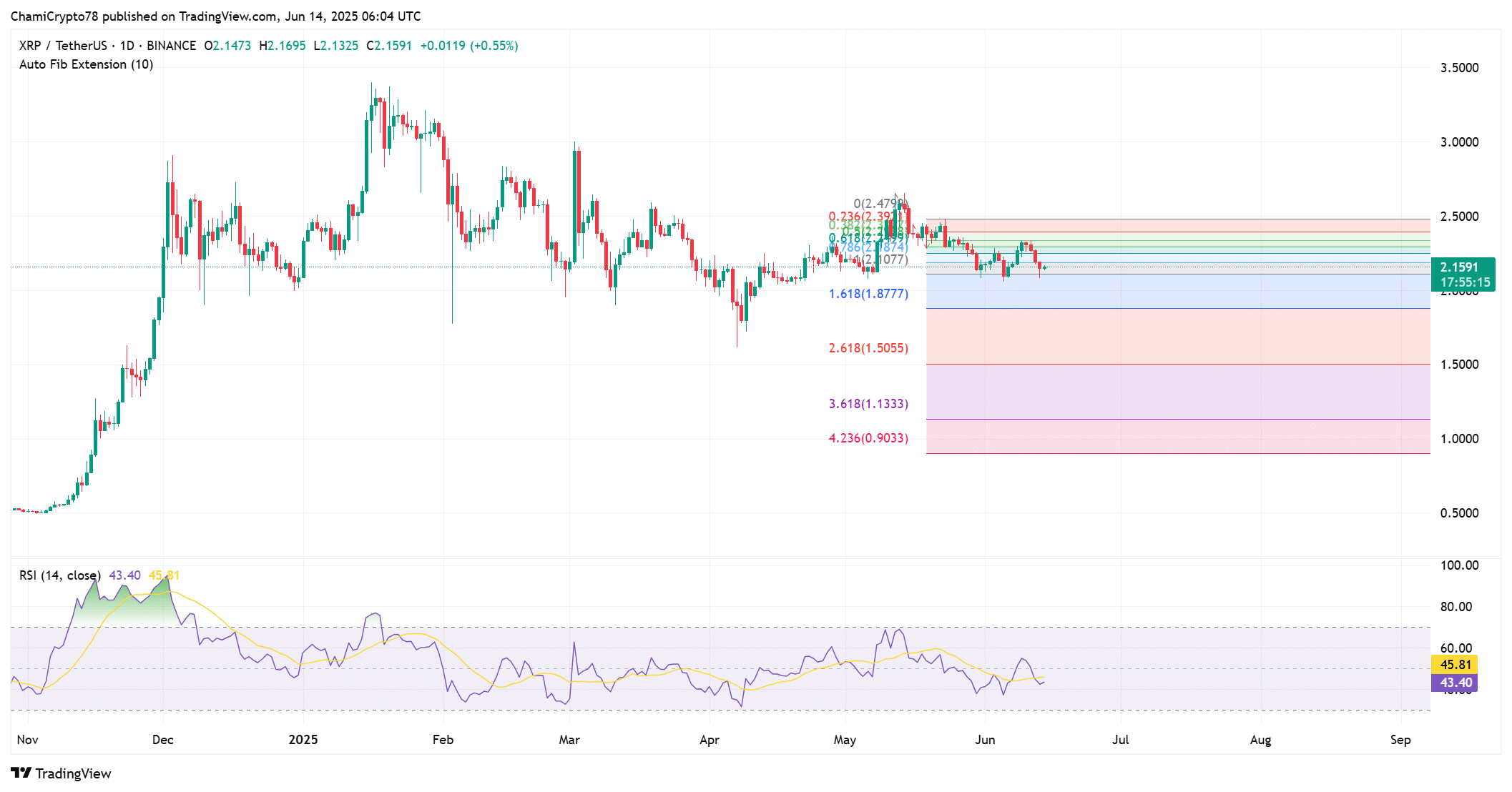

Can XRP defend its Fib support?

At press time, XRP traded around $2.15, just above the 1.618 Fibonacci extension at $1.87. This level acted as strong support.

The RSI sat at 43.40, suggesting the asset was neither oversold nor overbought, and was stuck in a consolidation phase.

Therefore, a decisive move above the nearby $2.39 resistance or a drop below $2.00 could determine the next direction.

Until then, sideways action may dominate as bulls and bears struggle for control near key levels.

XRP’s Futures volume dropped 36% to $3.99B, signaling a cool-off in leveraged trading. However, Open Interest slightly increased by 0.55%, suggesting some traders are still holding on to positions.

More strikingly, Options volume surged by 180%, while options Open Interest plunged 56%, pointing to a burst in speculative trading rather than long-term conviction.

This divergence between Futures and Options activity indicated that while some traders anticipated volatility, most are not committing significant capital just yet.

Is XRP’s foundation strong enough for a breakout?

XRP’s rising Realized Cap, strong long/short bias, and heavy short liquidations all point to growing bullish undercurrents.

However, weak RSI, low futures volume, and speculative options behavior suggest that traders are not yet fully committed to a breakout.

As long as XRP maintains support above $2.00 and $1.87, it could consolidate before a decisive move. A clean break above $2.39 may signal that XRP is ready to advance into a new bullish phase.