- SYRUP has been on a rally, driven by Futures traders opening long positions on the asset.

- Spot traders are opposing the rally, adding downward pressure on the price.

In the past 24 hours, Maple Finance [SYRUP] jumped 19%, pushing its monthly gain to 34%.

While market sentiment appears to support further upside, weakening signals remain that could oppose the asset’s momentum. Here’s how it could play out:

Investor sentiment fuels bullish rally

According to CoinGlass, traders have placed significant bets on SYRUP’s continued rally.

The Taker Buy/Sell Ratio, which tracks buying and selling activity in the derivatives market, shows increased buying activity as the ratio crossed above 1.

This buying trend coincided with a sharp rise in open derivative contracts.

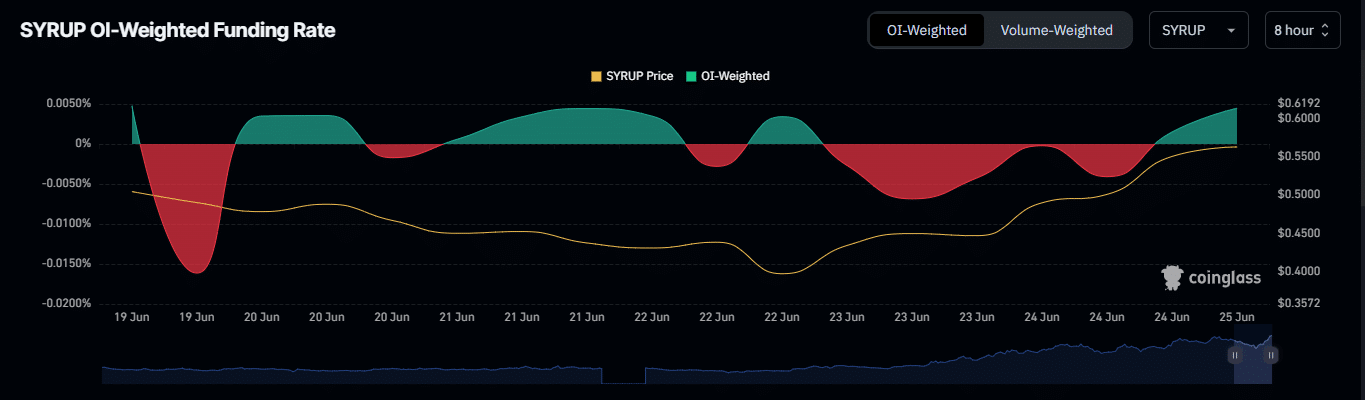

As of writing, the Open Interest Weighted Funding Rate stood at 0.0022%, confirming heightened activity.

When this metric remains in positive territory, it suggests strong bullish sentiment. A sustained upward trend indicates SYRUP could continue in this direction.

Also contributing to this outlook is a rise in Community Sentiment, a metric used to gauge whether investors expect a rally or price drop.

Press time data from CoinMarketCap showed that investors, despite SYRUP’s recent gains, are likely to continue holding the asset, supporting a more bullish long-term outlook, than take profit.

Rally faces resistance as selling pressure mounts

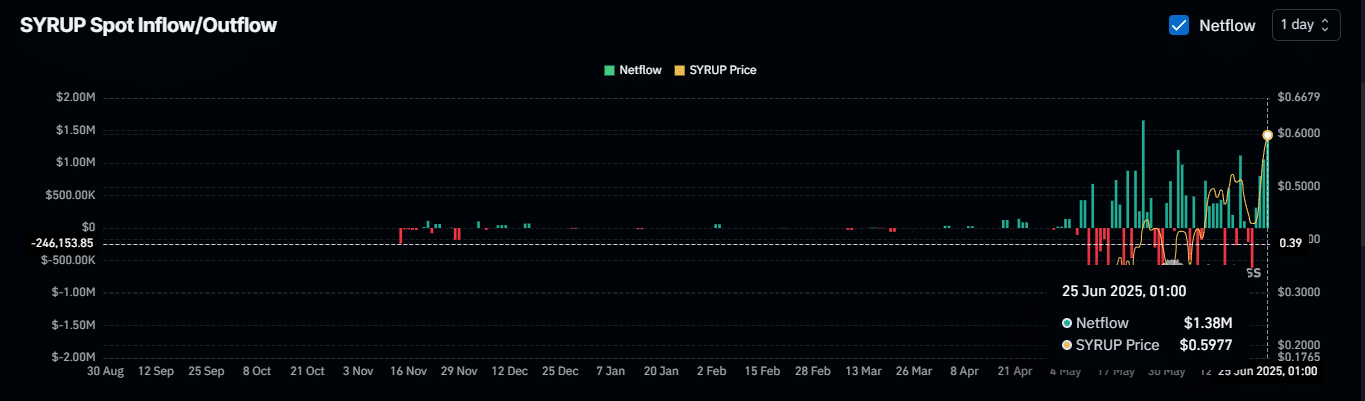

Despite the optimism, the rally is not confirmed. Some investors are placing sell orders, increasing downward pressure. Spot traders are contributing to this pressure.

As of writing, over $1.3 million worth of SYRUP has been sold, marking the second-highest daily volume for the asset this year.

This selling has continued for several days, bringing total weekly sales to $3.6 million; the highest level recorded.

If this selling trend continues, SYRUP risks losing the gains accumulated during the past four weeks of its rally. To assess its next move, AMBCrypto analyzed the asset’s liquidity position on the charts.

Liquidity analysis suggests mixed outlook

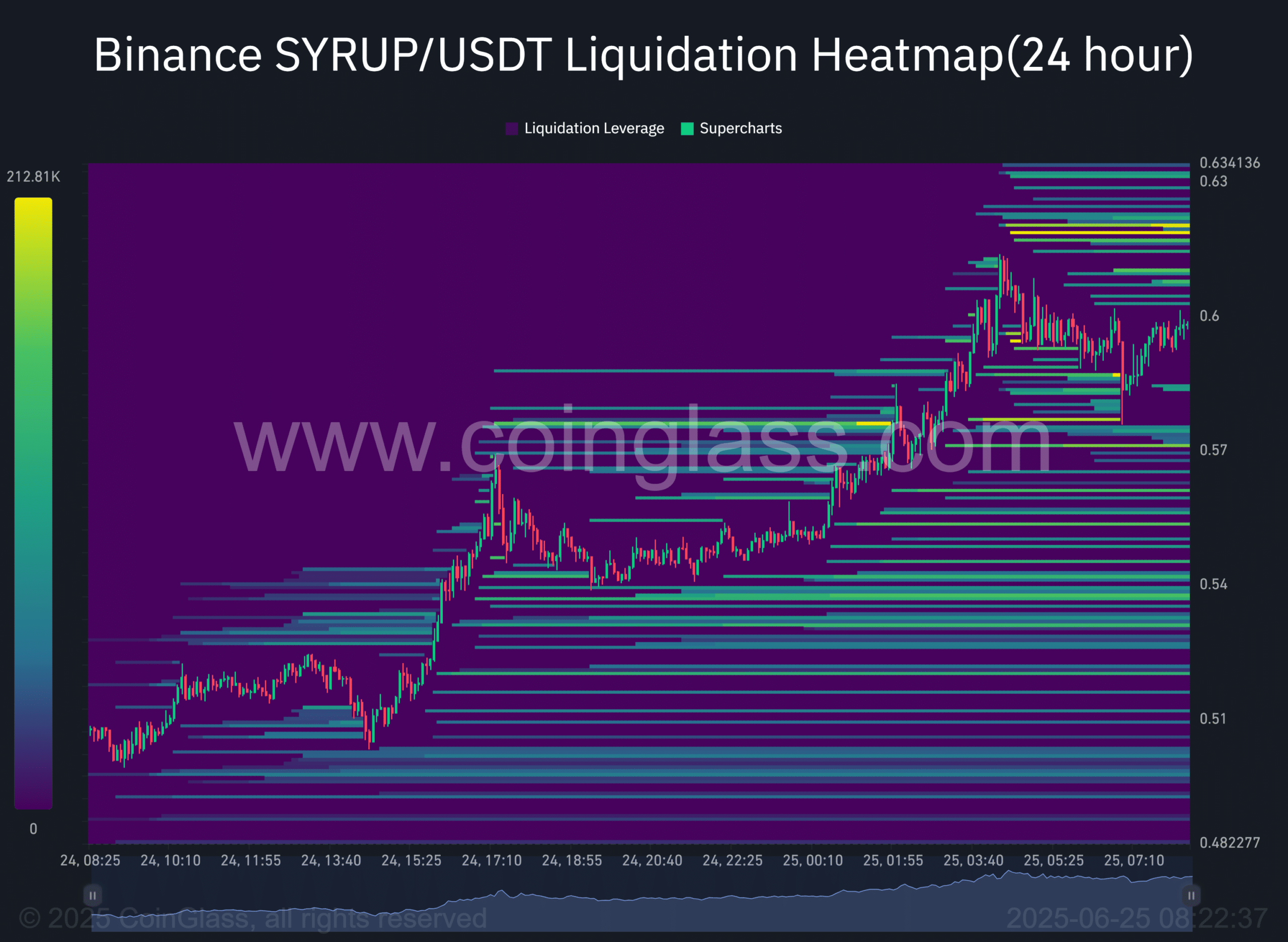

A review of the liquidation heatmap shows no clear directional bias for SYRUP.

There are liquidity levels both above and below the current price. However, there are larger liquidity clusters above, increasing the probability of an upward move.

When high liquidity sits above the current price and the price trends in that direction, it often indicates a likelihood of continued movement toward those levels.

If SYRUP first rallies into those zones and clears the unfilled orders above, it could then reverse downward, especially if significant unfilled orders also sit below.