- Whale Netflows surged 1,265% in a week, with large holders quietly accumulating Sonic near multi-month support.

- A breakout above $0.42 could flip the structure bullish, but for now, smart money is accumulating in silence.

Sonic [S] slipped 6.43% to $0.369, at press time, but whales didn’t flinch. Why?

Well, smart money traders have generated over $724K in Unrealized Profits in seven days, while Large Holder Netflows surged 1,265% within the same period.

And this spike in whale accumulation and consistent long-side positioning reflects growing institutional confidence.

This divergence between price action and investor behavior highlights a potential shift in market structure as strategic players quietly build exposure around key support.

Are whales silently accumulating Sonic while retail hesitates?

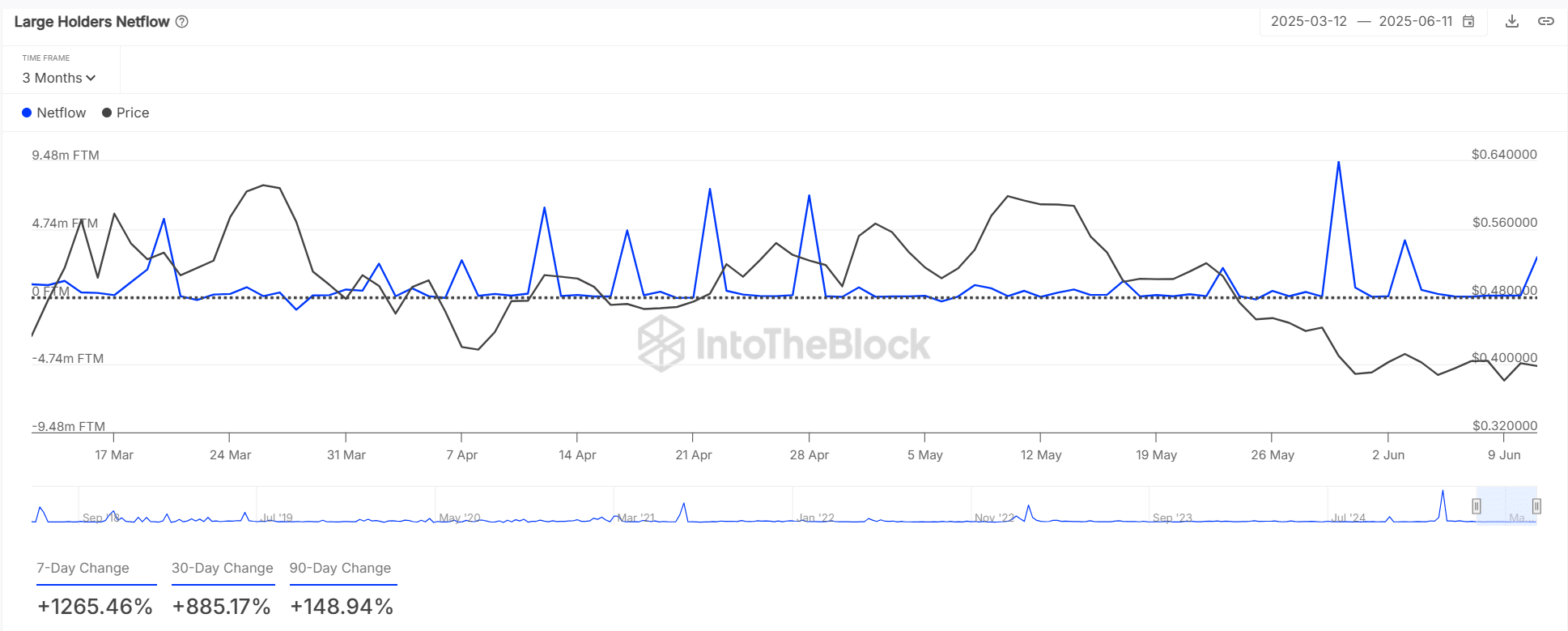

According to IntoTheBlock, whale Netflows rose 1,265% in just a week, and 885% over 30 days.

This consistent capital inflow reflects rising confidence among influential investors, even as prices test multi-month support levels.

The scale and timing of these inflows suggest whales anticipate a reversal and are positioning accordingly.

Retail investors, meanwhile, remain quiet, likely spooked by recent price volatility.

However, when whales accumulate near support zones, historical data often points to upcoming price inflection points, and Sonic may be no exception.

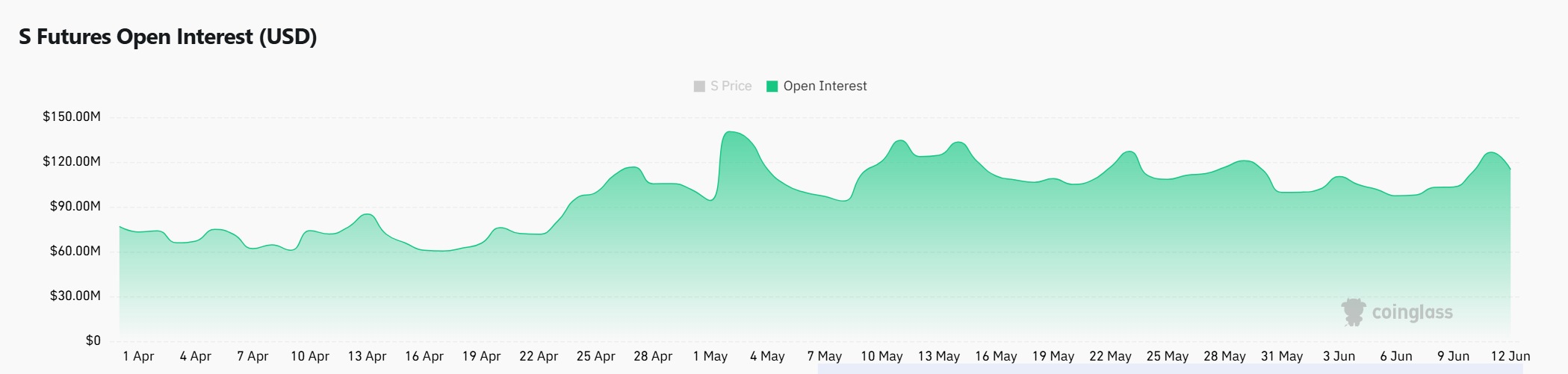

Does falling Open Interest reflect caution or consolidation before a move?

Sonic’s Open Interest dropped 8.04% to $114.53 million, suggesting traders reduced exposure.

However, this decline wasn’t necessarily bearish—it matched a consolidation phase, where leverage typically shrinks before a major move.

More importantly, past trends show Open Interest often spikes sharply after such cooldowns, usually during volatility breakouts.

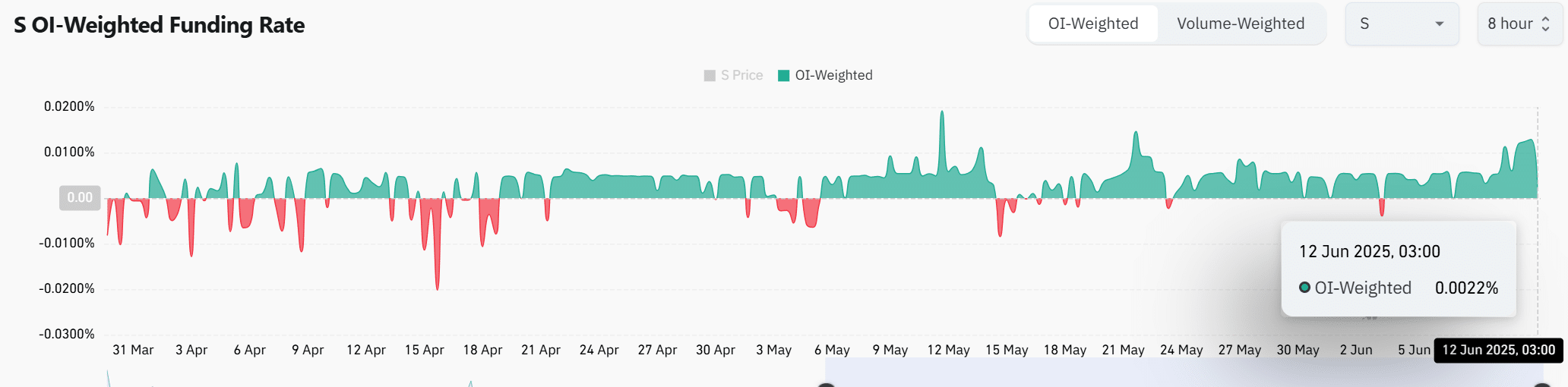

Could a positive Funding Rate be the first sign of a sentiment shift?

For the first time in weeks, Sonic’s OI-Weighted Funding Rate turned positive, now reading +0.0022%.

This indicates traders are paying a premium to hold long positions, hinting at growing optimism. While not aggressive, this shift contrasts with the previously neutral-to-bearish sentiment reflected in funding trends.

Positive funding often precedes bullish momentum, especially when paired with high accumulation and stable long positions.

Therefore, this small uptick may represent early signs of positioning ahead of a broader market rebound.

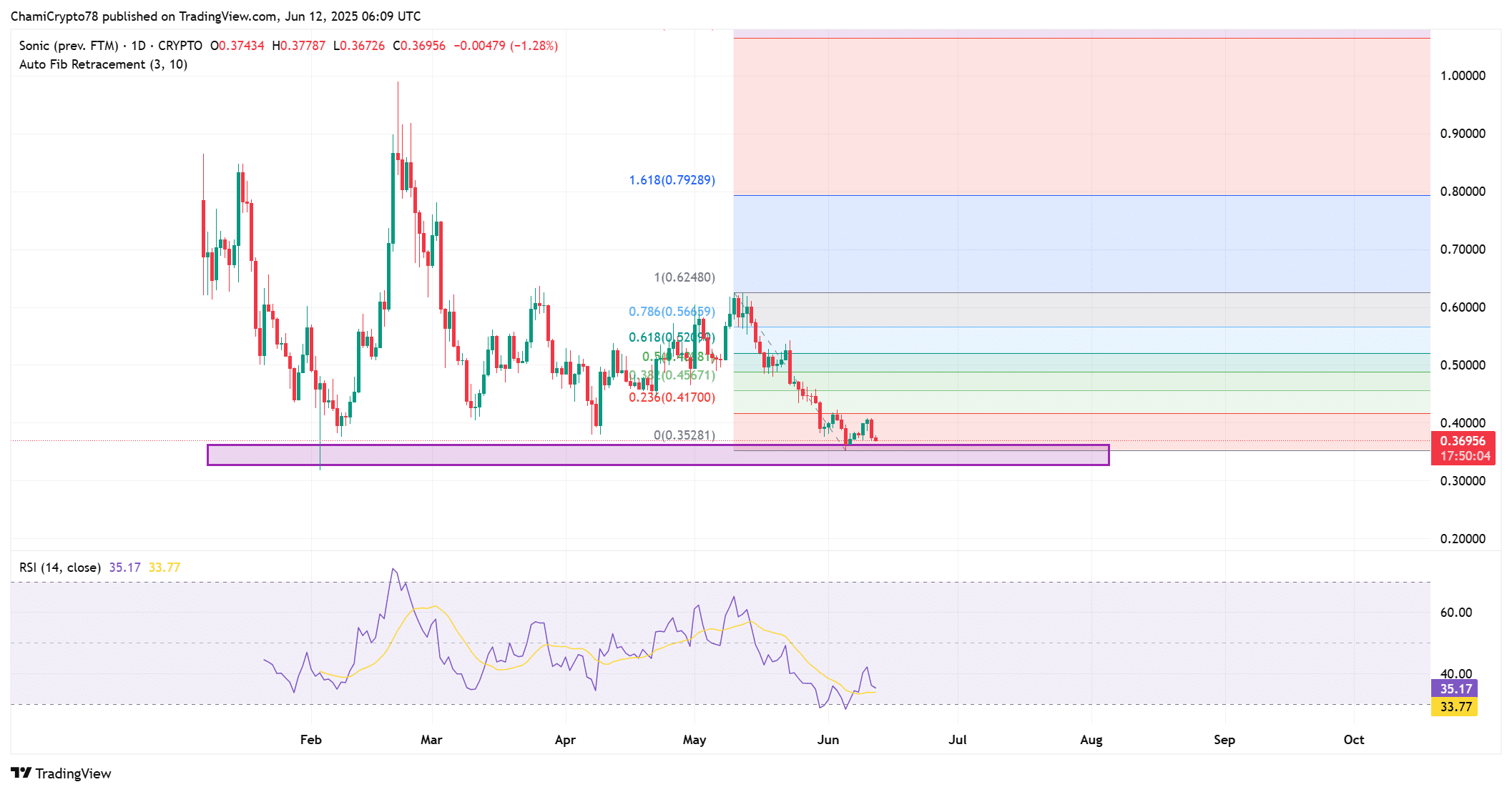

Is Sonic’s price base forming at a critical Fib support level?

At the time of writing, Sonic was consolidating above its Fib retracement low of $0.3528, with repeated tests of the support zone between $0.35 and $0.37.

RSI sat around 35, suggesting the asset is approaching oversold conditions. Historically, this area has triggered rebounds. Moreover, the flat structure and narrowing candle bodies indicate a potential build-up for a breakout.

If price clears the $0.42 resistance aligned with the 0.236 Fib, momentum could shift decisively bullish. Until then, patient accumulation continues under the radar.

Could whale activity and smart money profits spark Sonic’s recovery?

Sonic is showing multiple signs of bottom formation despite its recent 6.43% drop.

Whale accumulation, calm derivatives’ activity, and a flip in Funding Rates all point toward strengthening support. While price action remains muted, the groundwork for a bullish reversal appears to be forming.

If these trends persist and price breaks above resistance, Sonic could shift out of consolidation and into recovery.

Until then, smart money seems content quietly accumulating ahead of a potential breakout.