- Sei hits 621K active wallets and 1.17M transactions in a day, showing strong user momentum.

- TVL nears $1B, but DEX activity and stablecoin liquidity have dipped, signaling short-term caution.

The Sei [SEI] network recently recorded 621,000 active wallets and over 1.17 million transactions in a single day, hitting new all-time highs.

This surge comes amid rising engagement from gaming projects like World of Dypians, Europe Fantasy League, Hot Spring, and Archer Hunter.

While daily spikes often result from hype or incentives, Sei’s continued contract deployments suggest a steady developer base.

Therefore, the consistent growth in usage could signal something deeper than temporary interest.

If this level of activity persists, Sei may become a serious contender among high-performance Layer 1 chains targeting mass adoption.

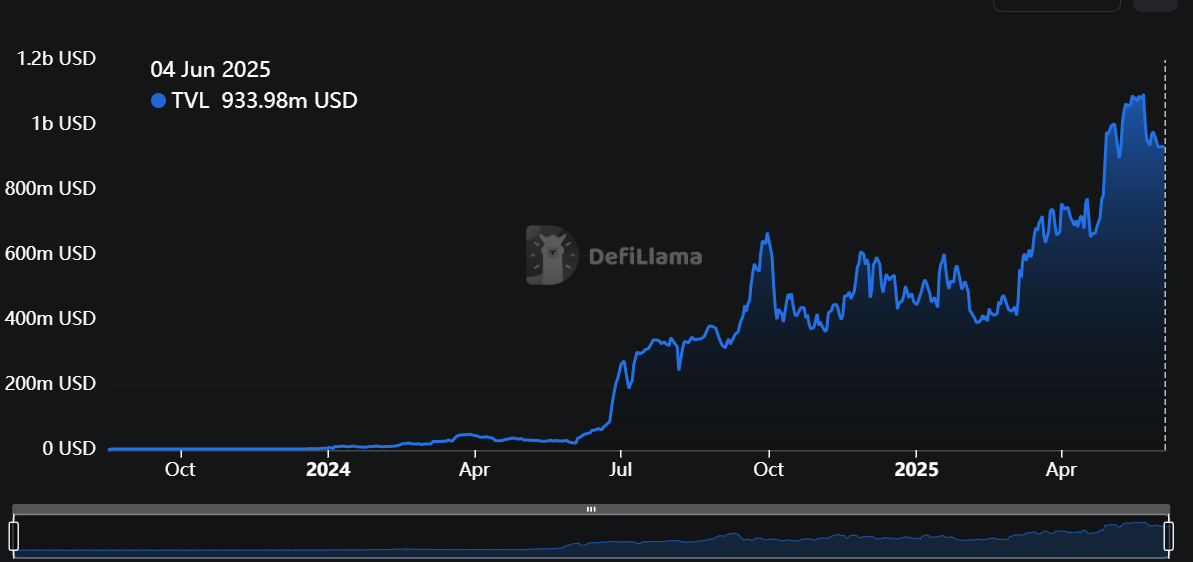

Can Sei’s TVL push past $1B and cement its DeFi status?

Sei’s Total Value Locked was at $930.59 million at press time, after briefly touching higher levels earlier this month.

Although TVL slipped slightly by 0.36% in the past 24 hours, the network has seen exponential growth since mid-2024.

This rapid increase reflects mounting trust among DeFi users and developers deploying capital into protocols on Sei. Sustained inflows into the ecosystem could push TVL above the symbolic $1 billion threshold soon.

Therefore, if institutional and retail liquidity remains steady, Sei could begin to rival more established chains in the competitive DeFi space.

DEX volume threatens trading momentum

Despite strong user activity, Sei’s decentralized exchange trading volume has dropped to $98.48 million for the week, marking a 13.62% decline.

The daily figure stands at $11.55 million, suggesting that speculation may be cooling temporarily.

This trend does not necessarily indicate weakness, as healthy networks often experience such fluctuations. However, the dip could reflect profit-taking or reduced participation by short-term traders.

Monitoring upcoming protocol launches and broader market trends will be key to understanding whether Sei’s DEX volume rebounds or continues its downward trajectory over the coming weeks.

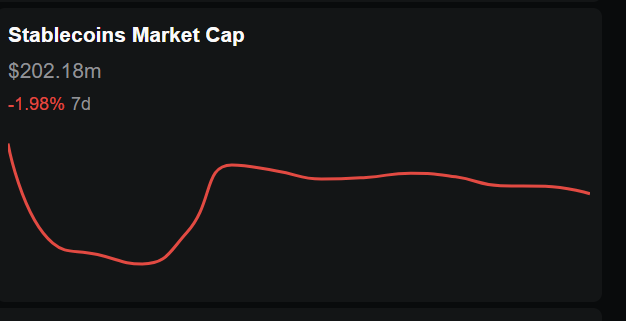

Is stablecoin shrinkage a red flag for Sei’s liquidity health?

Stablecoin liquidity on Sei has dipped to $202.18 million, down nearly 2% over the past week.

While not dramatic, this decline comes as user activity hits record levels—creating a slight mismatch between usage and liquidity.

If stablecoins continue to exit the network, DeFi protocols could struggle with reduced depth and higher slippage. However, this could also represent short-term repositioning rather than a fundamental outflow.

Therefore, it remains crucial to watch whether capital returns to Sei’s stablecoin pools or if the trend signals deeper hesitation from liquidity providers.

Conclusively, SEI has shown impressive growth across key metrics like user activity, contract deployments, and TVL, all of which signal strong foundational momentum.

However, the slight drop in DEX volume and stablecoin liquidity suggests short-term caution from traders and liquidity providers.

For Sei to establish true Layer 1 dominance, it must continue attracting sticky users, retain developer interest, and sustain capital inflows across DeFi protocols.

If these conditions hold, Sei is well-positioned to transition from a rising contender to a leading blockchain ecosystem.