- Whale accumulation surged as PENDLE saw over $8.3M withdrawn from Binance amid regulatory optimism

- Despite bearish funding rates and technical weakness, address and transaction activity revealed rising adoption

More than 2.18 million PENDLE worth $8.31 million was withdrawn from Binance within six days. This could be a sign of rising institutional interest, especially as the SEC’s DeFi regulations gain momentum.

This activity seemed to be in line with the SEC’s growing support for regulatory fairness in DeFi. This may be encouraging traditional players to explore compliant yield-bearing protocols. At the time of writing, PENDLE was trading at $3.82, up 1.24% in 24 hours.

With mounting interest from both sides of the aisle—regulators and institutions—the market is now watching closely for what could become DeFi’s next adoption inflection point.

Are growing address stats a signal of sustainable demand?

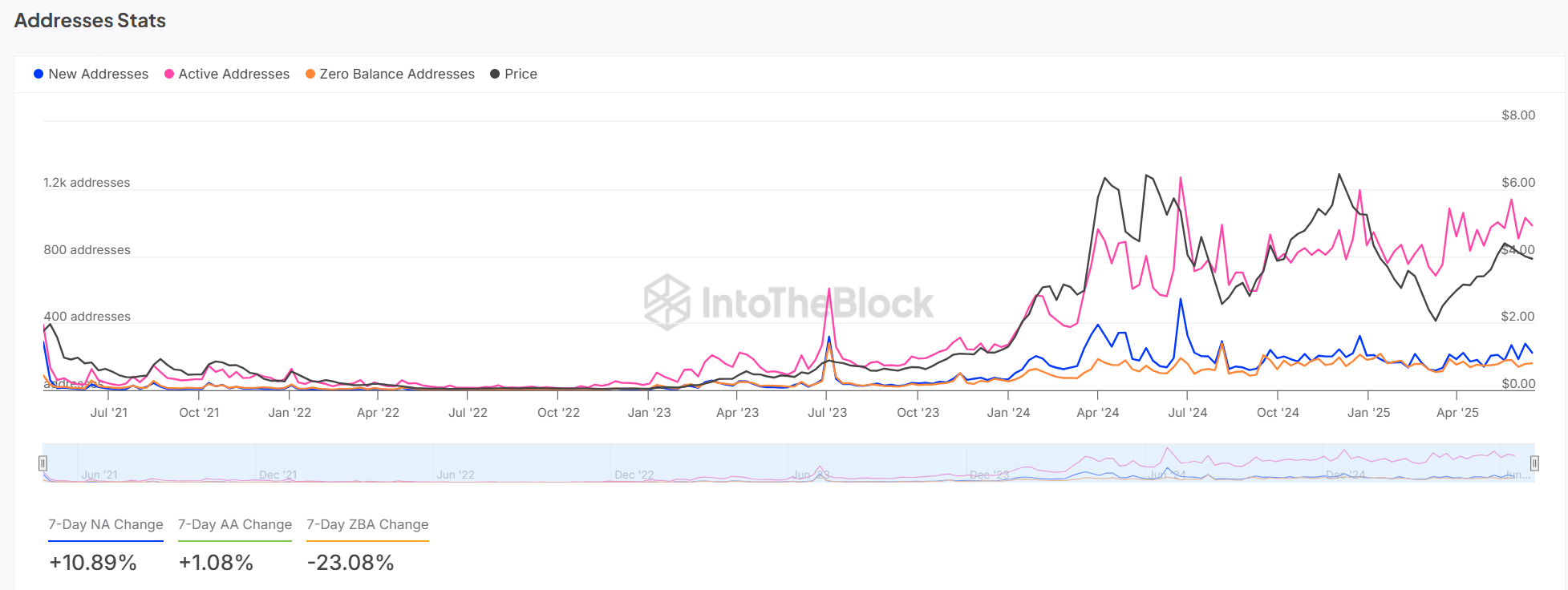

Pendle’s on-chain growth has been strong lately, especially from smaller participants. New addresses jumped by 10.89% in seven days, while active addresses rose slightly by 1.08%.

Such a consistent hike in user activity could allude to healthy protocol engagement and potentially rising organic demand.

In fact, despite recent price fluctuations, the network continues to attract new users, indicating that Pendle’s DeFi utility has been resonating with a broader crypto audience.

Hence, the persistent address growth can be seen to be supportive of a long-term bullish case. Especially if regulations continue to open the door for traditional investors.

What does a 300% jump in whale trades say about market conviction?

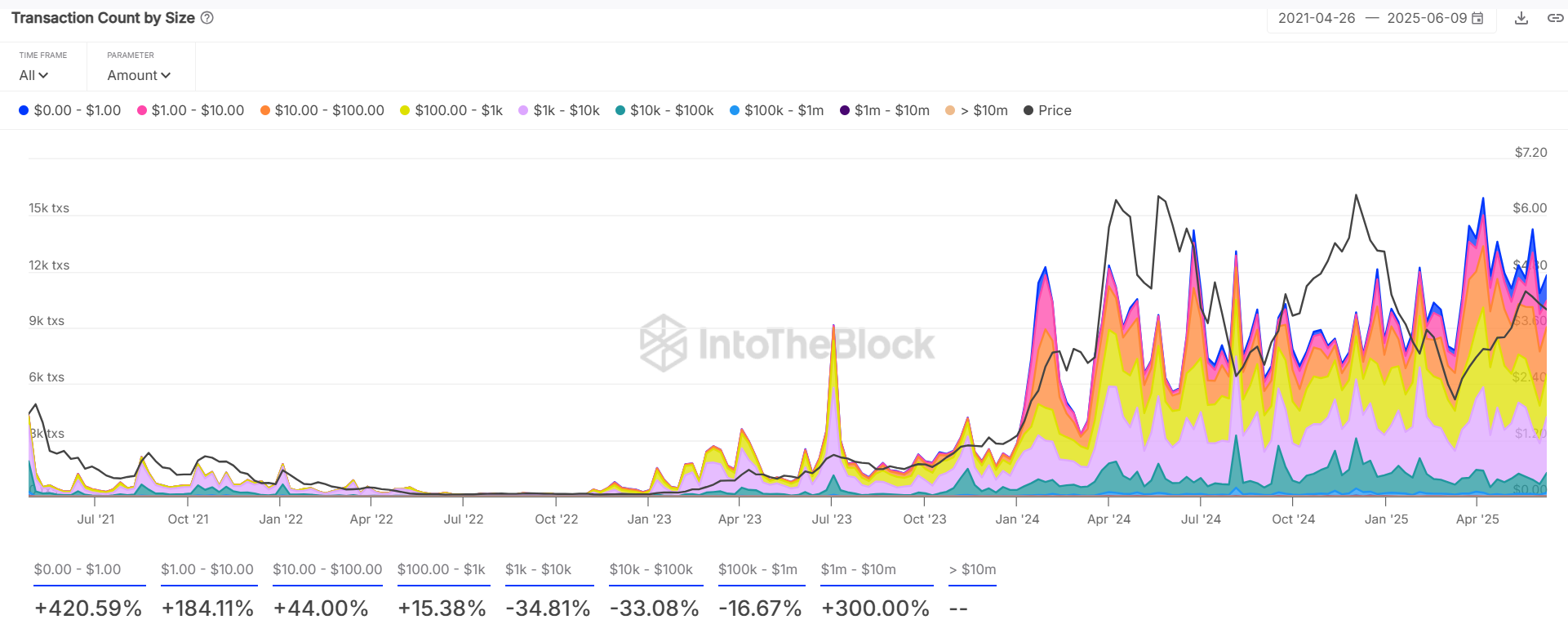

A massive 300% increase in $1M–$10M transaction volumes revealed a significant shift in market dynamics. These large trades—likely driven by institutional players—occurred alongside rising mid-tier activity in the $1–$100 range, which grew by 184.11%.

Such a dual trend means that Pendle has been capturing interest across the board, from whales to retail participants. The spike in transaction diversity could hint at growing trust in Pendle’s role within the DeFi yield ecosystem.

However, if this capital is speculative rather than conviction-based, short-term volatility might remain elevated.

Is Pendle’s valuation outpacing its on-chain activity?

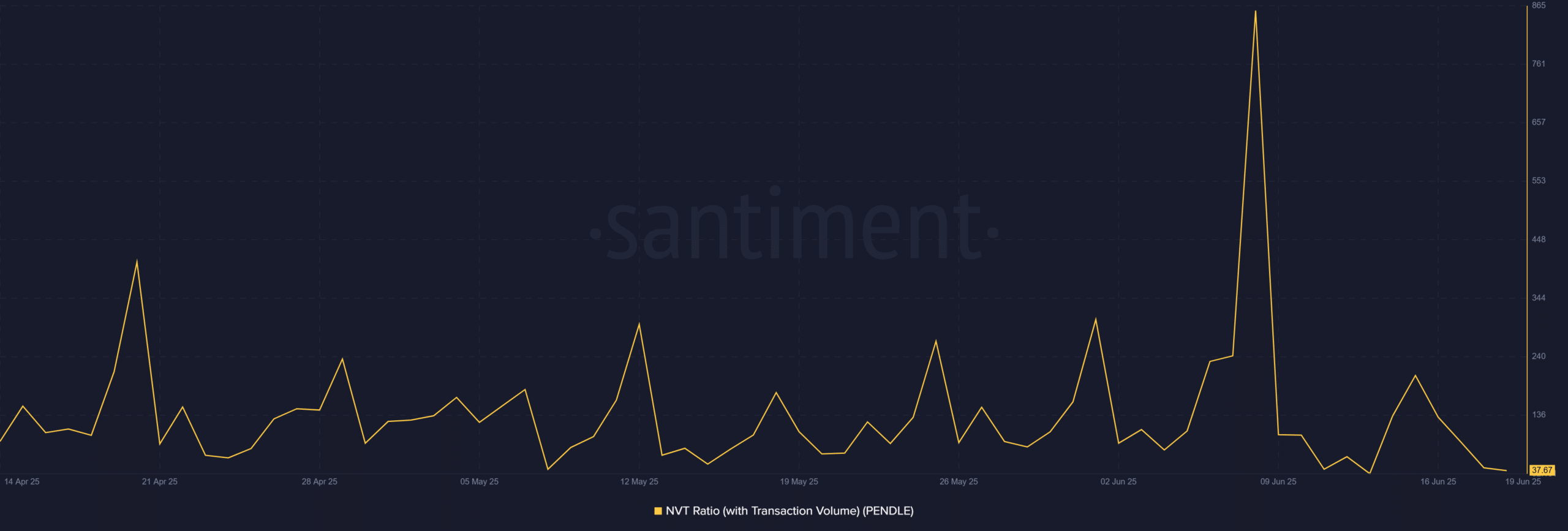

The NVT ratio soared to 865 before retracing to 37.67 – A sign of recent overvaluation relative to network throughput.

Historically, such spikes indicate temporary disconnection between the price and transaction volume. As a result, traders and investors should remain cautious about potential price corrections.

However, the decline in NVT after the peak also hinted at greater usage or a fall in market cap – Both of which could normalize Pendle’s valuation in the short term. In either case, the token may need to consolidate before setting up for a stronger move.

Has PENDLE’s bullish structure broken, or is this a healthy retest?

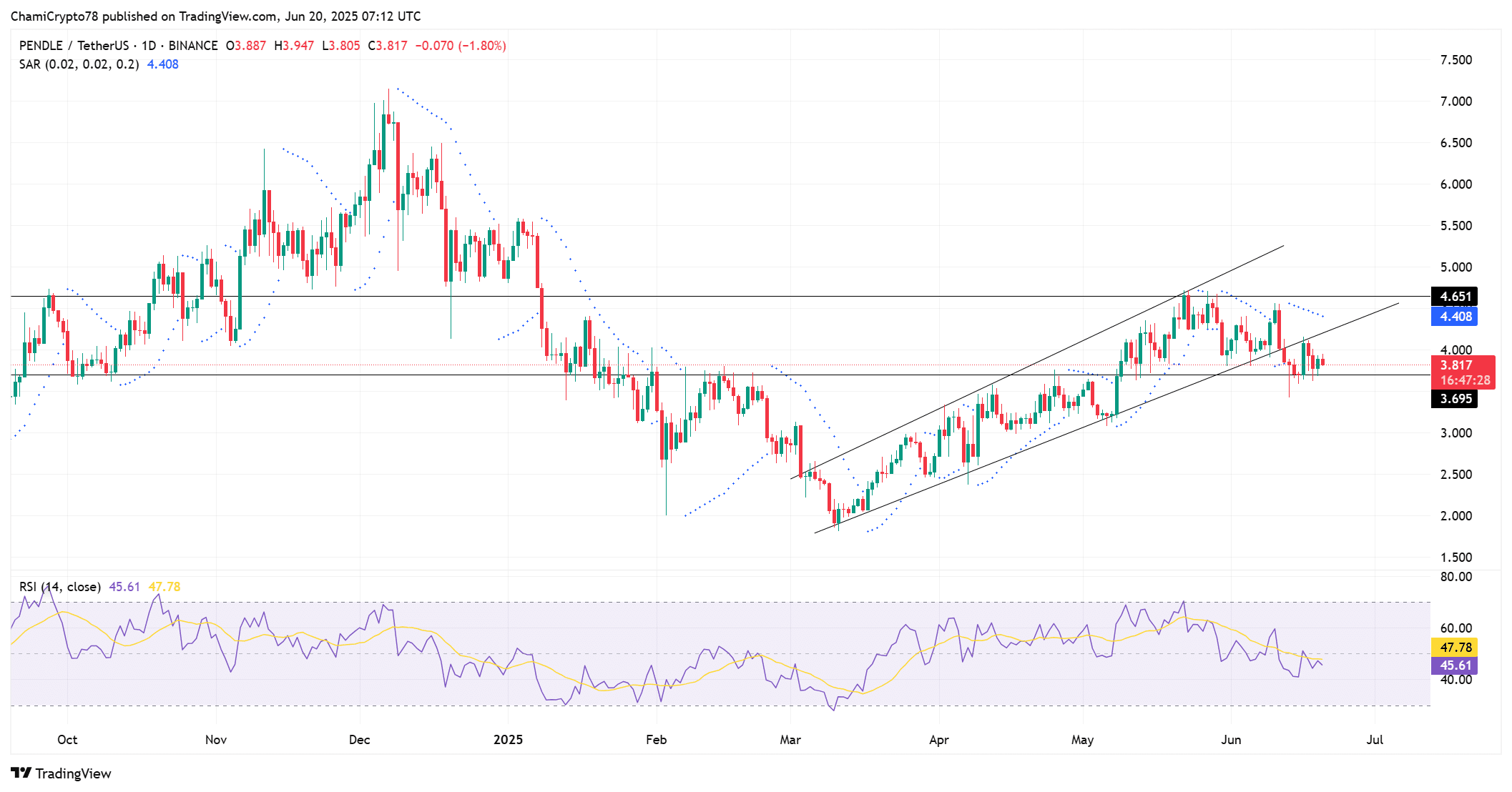

Technically, PENDLE broke below its ascending channel on the charts, with its price hovering around $3.82 with support at $3.69.

At the time of writing, the RSI sat at 45.61 – A sign that momentum has been neutral, but fragile. The Parabolic SAR dots flipped above the price, reinforcing a short-term bearish outlook.

However, if bulls reclaim the $4.4- level, the structure could reset bullish. Ultimately, with regulatory winds shifting and whales accumulating, PENDLE may be in consolidation rather than a breakdown, awaiting a catalyst to resume its DeFi-driven ascent.

Although PENDLE’s short-term structure has been fragile, the surge in institutional accumulation paired with the SEC’s favorable tone towards DeFi presents a compelling long-term thesis.

If regulatory clarity continues to improve, Pendle could emerge as a strategic vehicle for compliant yield exposure.

Therefore, while technical headwinds remain, the fundamentals seemed to suggest confidence in DeFi’s future.