- Tether and Circle’s plans to centralize stablecoin supply have raised centralization concerns.

- Tether-backed Plasma’s XPL token could explode if the stablecoin craze extends.

There’s no doubt the market is ready for stablecoin growth, going by the exceptional success of Circle’s IPO.

To further streamline stablecoin rails, the incumbents have opted for separate and specialized ‘networks.’ Tether is banking on Plasma for an optimized USDT issuance, while Circle Payment Network (CPN) aims to reduce friction in global money transfers.

However, Ryan Berckmans, an Ethereum community member, has flagged these issuers’ moves. He viewed them as ‘alternative L1’ networks that would be a ‘centralization risk’ and ‘unnecessary.’

“These new alt L1s represent unnecessary and risky centralization and capture attempts from stablecoin incumbents, and are a net negative to users, merchants, LPs, governments, tradfi new entrants.”

Source: Ryan Berckmans/X

Is Ethereum’s stablecoin dominance at risk?

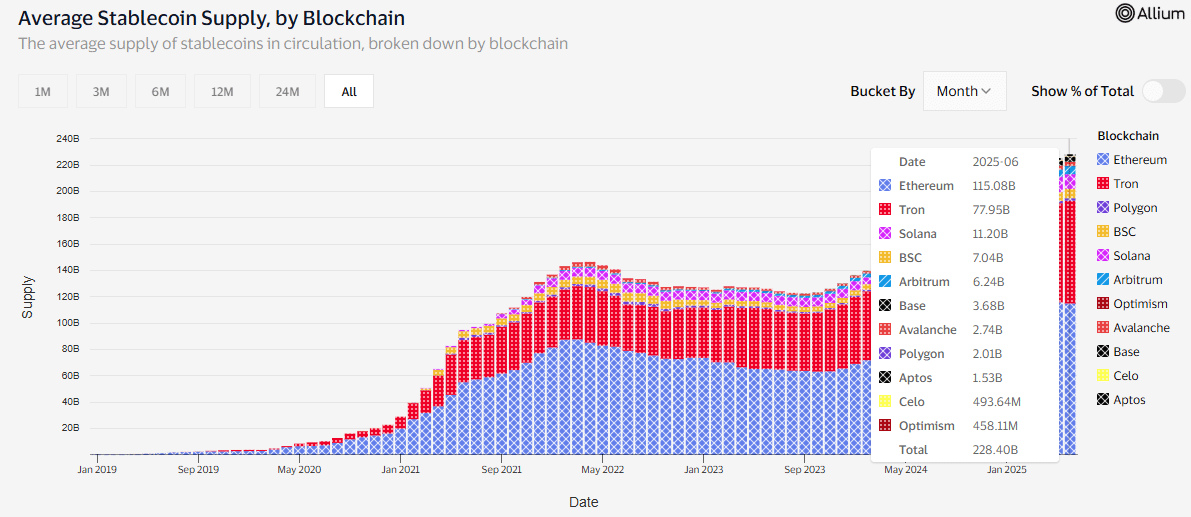

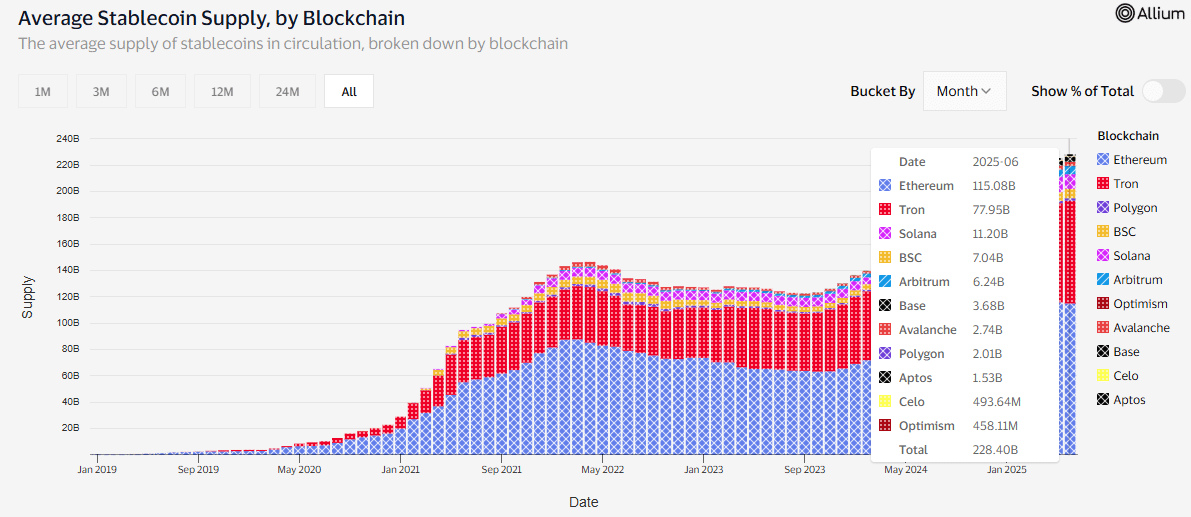

Berckmans’ concerns ain’t surprising given Ethereum’s [ETH] dominance in the current stablecoin supply.

Visa data showed that the chain controls $115 billion of the overall stablecoins market, followed by Tron [TRX] at $80 billion.

Source: Visa

While it may still be early to quantify the overall impact of Tether-backed Plasma or Circle’s CPN on the stablecoin supply dynamics, Berckmans urged other issuers to focus on Ethereum.

“Competitors of Tether and Circle, including new entrants such as tradfi firms and banks, should seek to launch ETH L2s that bundle the firms’ own new stablecoins, RWAs, onchain products, and owned distribution into a strategy similar to Base.”

Berckmans argued that having stablecoin liquidity in Ethereum could improve DeFi opportunities and maximize yield.

Interestingly, a similar reasoning could be behind Tether backing Plasma. According to Messari analyst Sam, Plasma would be a Bitcoin sidechain and allow Tether to drive BTC DeFi and USDT offramps.

“Like Circle Payments Network, Plasma serves as a payments network for banking partners and custodians to support USDT offramps.”

Already, Plasma has recorded massive investors’ interest with $500M raised within minutes during Monday’s token sales [XPL].

If the stablecoin craze continues, Plasma’s XPL token could see market interest similar to Circle’s IPO.

Stablecoins are digital dollars that bridge crypto to traditional finance, with use cases across payments, remittance, and crypto trading. For perspective, the stablecoin sector has grown 4,600% from $5B to $240B in the past five years.

But overall crypto market surged about 700% over the same period from $0.25 trillion to over $3 trillion.

However, it has been challenging to gain direct investment exposure to the stablecoin growth until Circle’s IPO. CRCL stock jumped 300% from a pre-IPO value of $31 to over $122 before easing to $117 at press time.

If the trend repeats itself, Plasma’s XPL will be a key token to track when it launches.