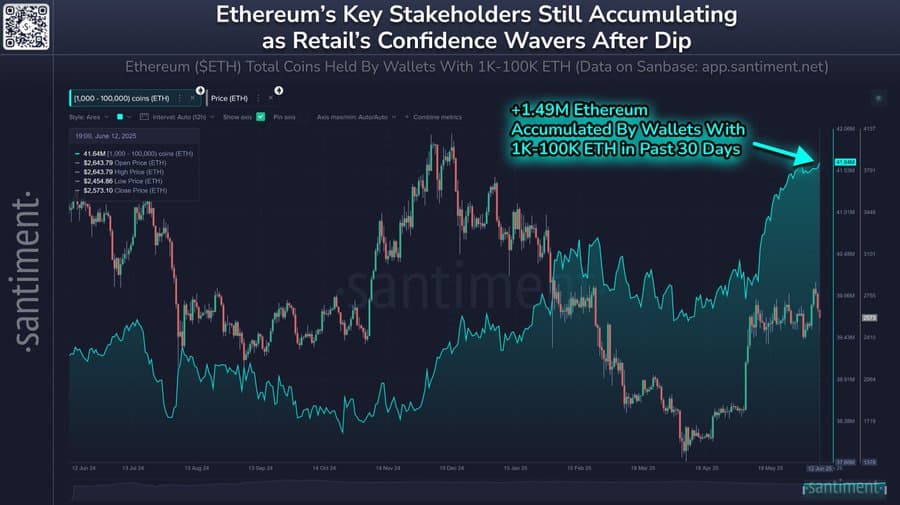

- Whale accumulation has increased by 1.49M ETH, while retail participation and address activity continued to decline.

- There is cautious sentiment despite investor accumulation trends.

Over the past 30 days, Ethereum [ETH] whale and shark wallets have added over 1.49 million token to their wallets, pushing their total share to nearly 27% of the circulating supply.

This accumulation came as retail traders locked in profits, allowing larger holders to steadily increase their control.

Despite the dip in market sentiment, these strategic entities have expanded their holdings by 3.72%, suggesting growing conviction.

The shift in supply distribution hints at a potential reversal, especially if retail activity begins to realign with this long-term bullish behavior.

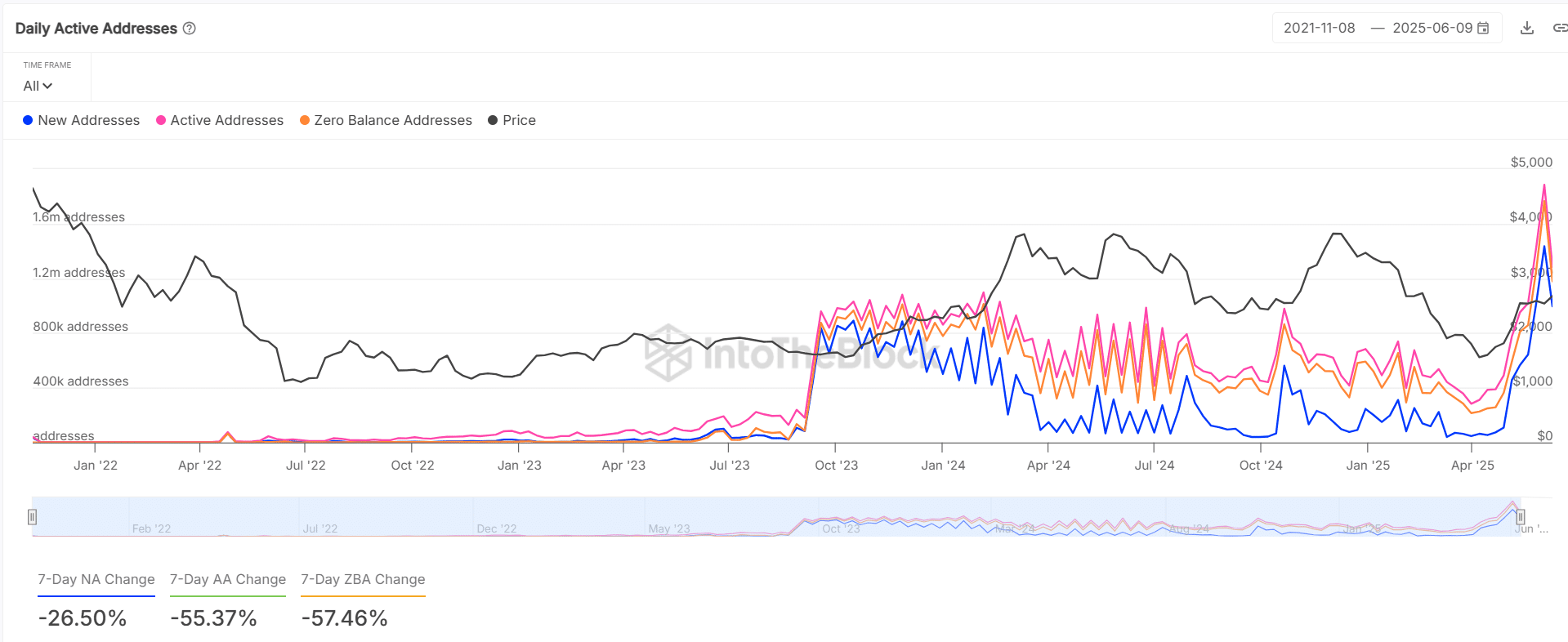

Is ETH losing retail momentum?

While large holders are positioning for long-term gains, retail participation has declined sharply. New addresses dropped -26.50%, and active addresses plunged by -55.37% in the past seven days.

Additionally, transactions above $1M dropped more than -45%, and those above $10M completely vanished.

Meanwhile, smaller transfers between $10 and $100 surged by over 106%, revealing short-term speculation rather than conviction.

These trends show that although Ethereum’s price has stabilized, smaller participants remain hesitant.

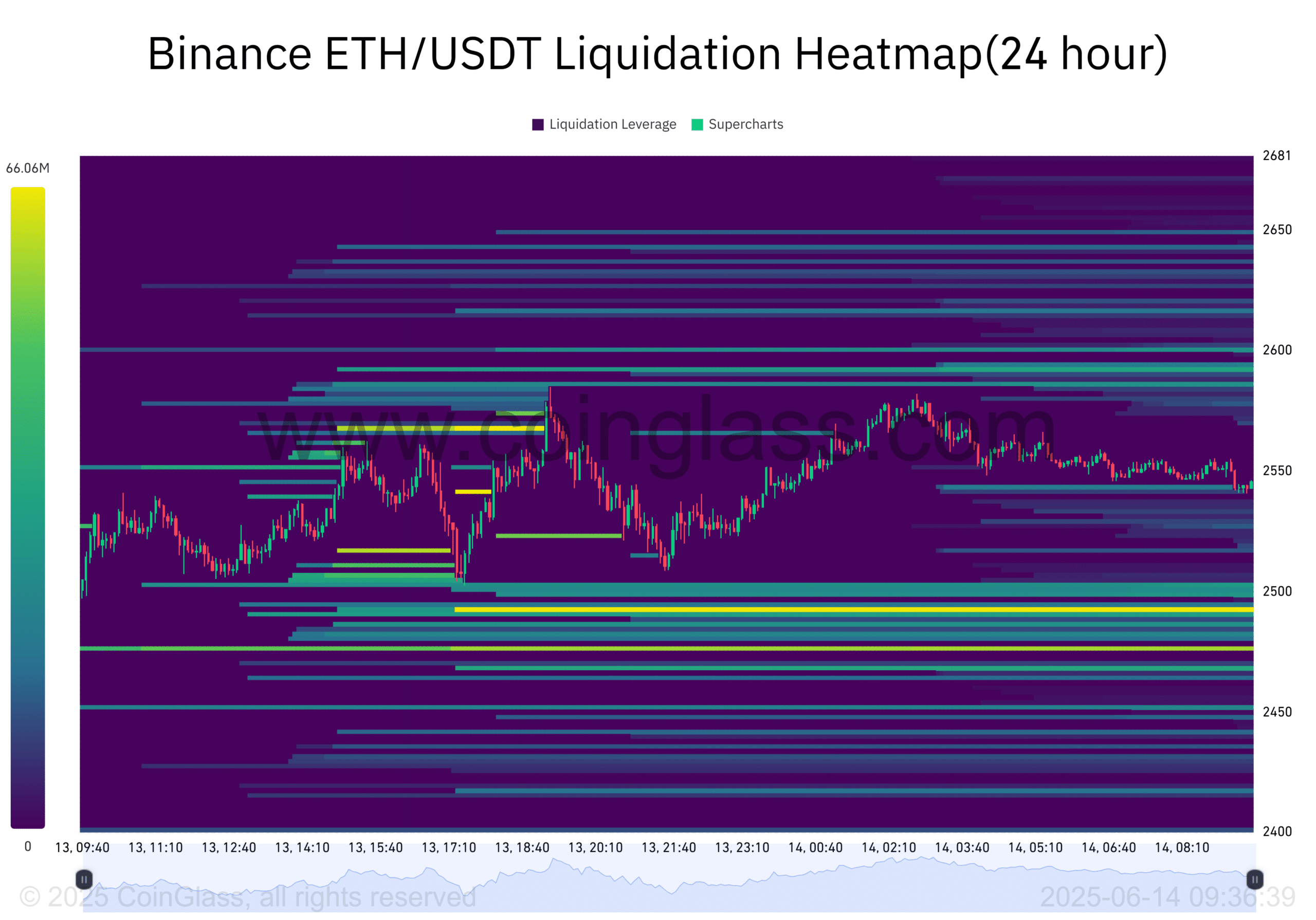

ETH’s momentum in danger

The latest liquidation heatmap revealed a dense concentration of long liquidations around the $2,550–$2,650 range.

Ethereum’s price recently climbed into this zone, triggering caution among leveraged traders. This area now acts as resistance, with significant liquidity set to unwind if prices fail to hold.

If bulls manage to breach this wall, short liquidations could accelerate upside pressure. However, failure to push higher may lead to a swift correction.

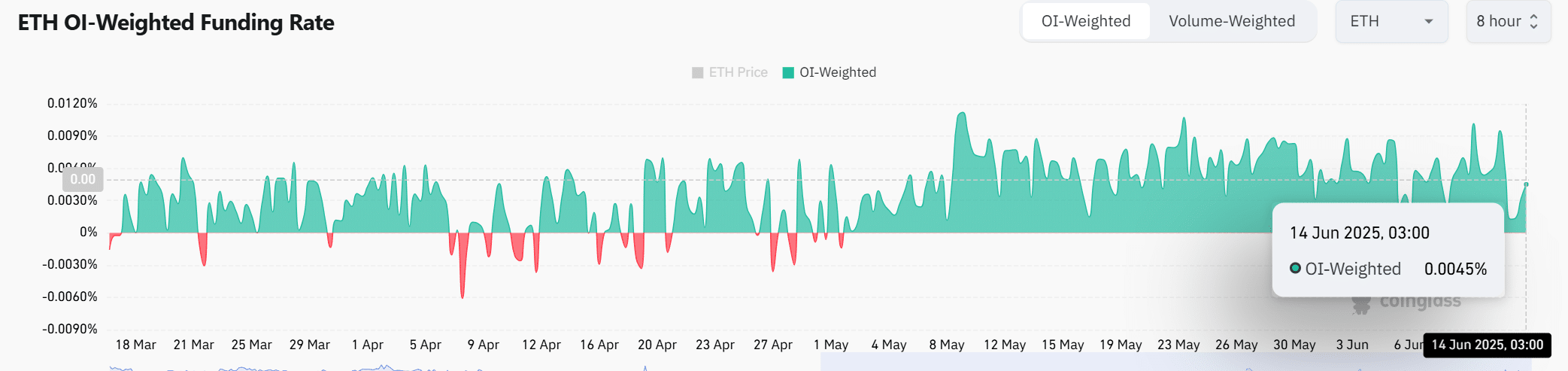

True confidence or mild optimism?

Despite price movement and whale accumulation, Ethereum’s Funding Rate remained slightly positive at +0.0045%.

This suggested a modest long bias among Futures traders, but lacked the intensity seen during breakout phases. The absence of high leverage build-up implies caution, not conviction.

Therefore, while sentiment leans bullish, it reflects careful positioning rather than aggressive risk-taking.

Until Funding flips sharply positive or Open Interest surges, the market may remain range-bound. This muted enthusiasm reflects the current wait-and-see approach among traders.

Whales gain control

According to historical concentration metrics, whales increased their holdings by +1.89%, and investors by +14.48% over the past 30 days. In contrast, retail holders reduced their share by -0.91%.

This shift in ownership underlines a quiet rotation of capital from weaker hands to stronger ones. The continued accumulation by these groups reinforces the idea of long-term bullishness.

As whales tighten their grip on supply, Ethereum’s resilience may strengthen—even without significant retail involvement for now.

Ultimately, Ethereum’s on-chain metrics suggest bullish accumulation by key stakeholders while retail interest continues to wane.

However, without a retail resurgence and a strong break above $2,650, ETH may remain range-bound in the near term.

The market now waits for a catalyst to align whale confidence with broader trader momentum.