- Ethereum has twice dipped harder than Bitcoin this month, only to bounce back stronger.

- With structural support intact, is ETH coiling for a parabolic breakout?

June’s only halfway through, and Ethereum [ETH] has already absorbed two sharper corrections than Bitcoin [BTC], each time posting double-digit drawdowns during waves of market-wide FUD.

But beneath the surface, this isn’t random. It shows a calculated reset.

According to AMBCrypto, it might be the kind of shakeout bulls need to build momentum and flip resistance zones with conviction – surely something that’s worth keeping on your radar.

Spot demand steps in as derivatives cool off

Ethereum kicked off June with a solid 10.77% dip, hitting a mid-week low around $2,393, right as Bitcoin slipped 4.44% off its $105k resistance.

What followed was a decisive recovery.

ETH rebounded 20.3% off the lows, clearly outpacing Bitcoin’s 10.03% move in the same window. That kind of relative strength post-capitulation reinforced Ethereum’s structural support.

Now, the current setup is beginning to echo that same sequence. Another round of market-wide FUD (sparked by geopolitical tensions) knocked Bitcoin down to a mid-week low of $102,832, a 7% dip from its weekly high.

Ethereum followed with a sharper 14.9% pullback, dropping to $2,441. But this wasn’t just a spot-driven move. As AMBCrypto flagged, the drop was triggered by a heavy round of futures deleveraging.

Yet what’s notable is ETH’s swift recovery. At press time, it has already reclaimed over 50% of the drop, trading at $2,619.

Clearly, the leverage flush didn’t dent underlying demand. Instead, it once again reinforced ETH’s strong bid-side interest.

Setting the stage for Ethereum’s next parabolic leg

Nothing underscores ETH’s resilience quite like its futures setup.

Despite the recent liquidation wave, Ethereum’s Open Interest has rebounded 5% to $36 billion, while funding rates remain firmly positive, signaling a strong long-side bias.

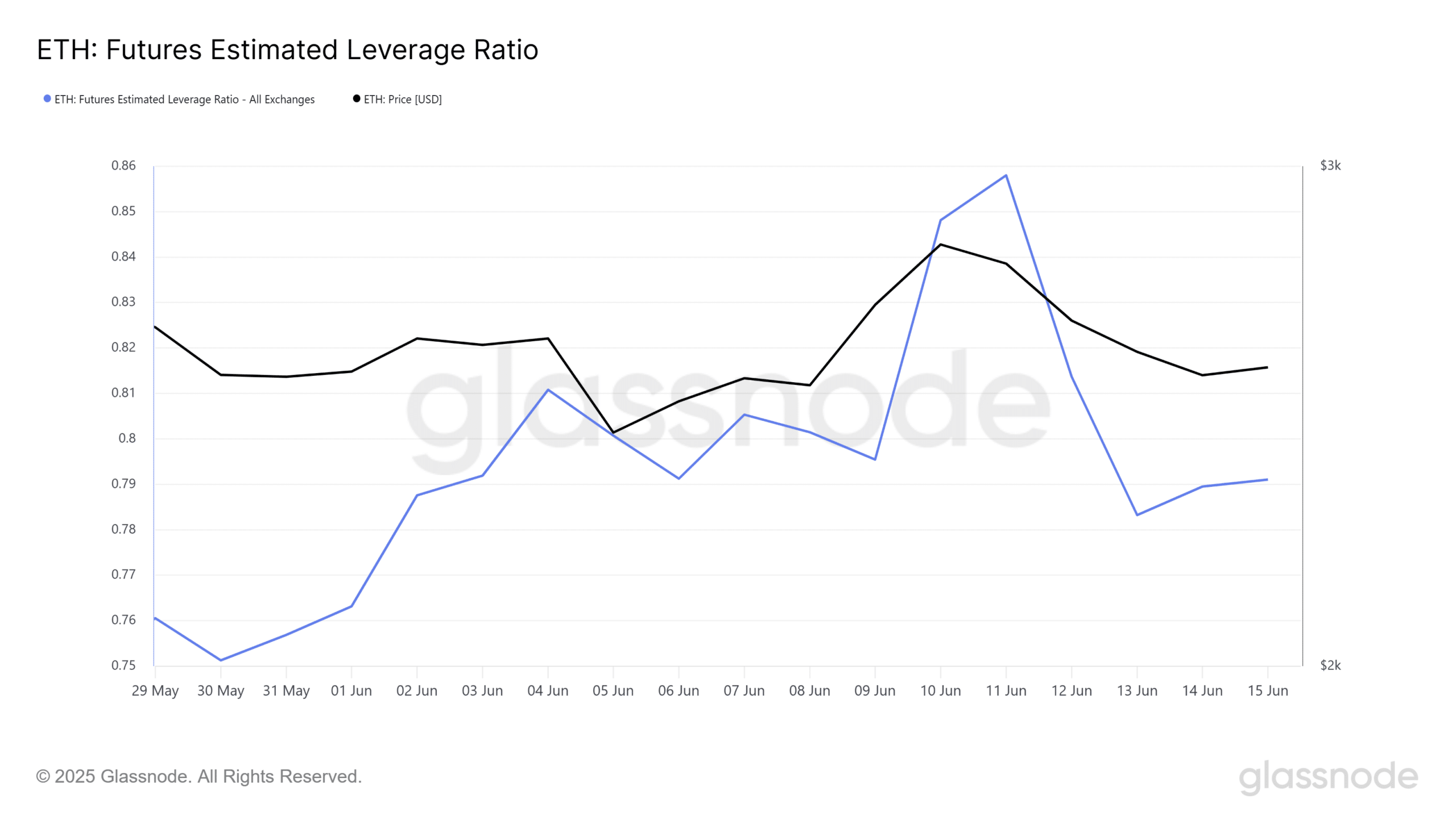

Meanwhile, the Estimated Leverage Ratio (ELR) across exchanges is ticking higher again after a sharp 9% reset to 0.78 last week. In short, leverage is rotating back in, and repositioning is rebuilding fast.

Backed by firm spot demand, Ethereum is now outperforming Bitcoin with a 3.55% gain at press time, echoing the post-liquidation strength seen in the past two cycles.

This pattern matters. Each cycle has seen Ethereum reset higher, establish stronger structural support, and use that foundation as a launchpad for parabolic recoveries.

If it holds, the setup shifts from “high-risk” to “high-reward”, making $3k just the starting line as we move into Q3.