- Ethereum ETFs outpaced Bitcoin ETFs during the mid-week spike in market volatility

- Traders have been heavily hedging in the short term, underscoring caution after the Musk-Trump drama

U.S Spot Ethereum [ETH] ETFs (exchange-traded funds) showed resilience on the charts, despite Thursday’s heightened market volatility. Notably, the products logged in $11.26 million inflows on 5 June.

On the contrary, Bitcoin ETFs saw $278.44 million in daily outflows. This was an outperformance that showed institutional investors’ vote of confidence in ETH during the recent risk-off move. So far, ETH ETFs have attracted positive inflows for 16 days straight.

Despite the institutional demand though, ETH dropped by 7% amid a broader risk-off move.

Assessing ETH’s price recovery

On Thursday, ETH dipped from $2.6k to $2.39k, before reclaiming $2.4k at press time. Notably, profit-taking surged to $454 million on the same day.

For leveraged traders, bulls lost $256M in forced liquidations in the past 24 hours. Shorts lost only $30M.

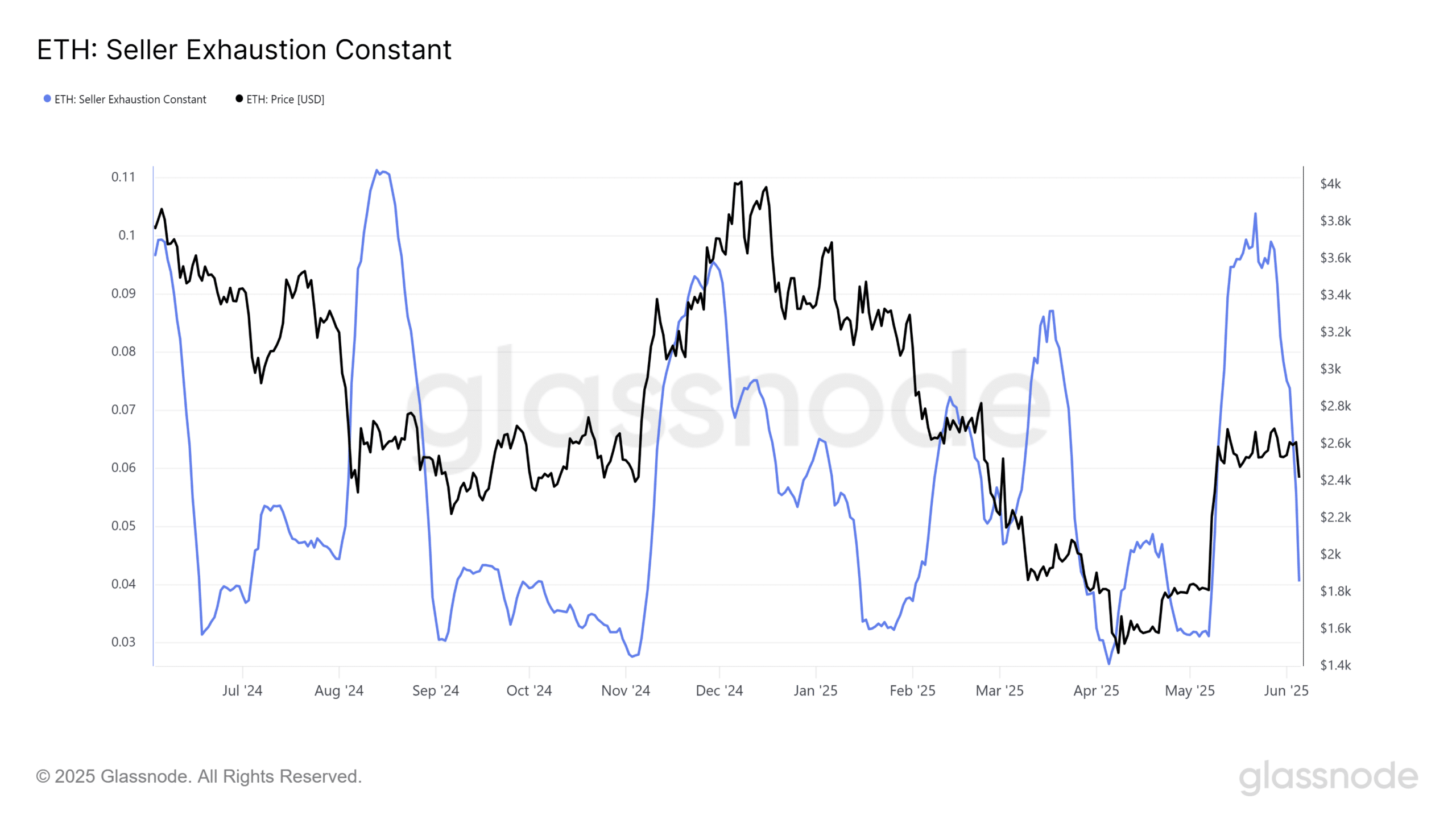

However, at the time of writing, overall selling pressure had declined. In fact, the seller exhaustion constant indicator dropped to levels last seen in April – A sign that ETH was in a buy and low-risk zone.

This indicator tracks ETH profit-taking and price volatility. Spikes are typically associated with risky local tops. On the contrary, low readings correctly flagged local bottoms in April and last October.

Worth noting, however, that trader Income Sharks highlighted that the altcoin is still on an uptrend after defending a $2.3k low range. According to him, ETH still has a shot at retargeting $3k.

Interestingly, the altcoin has seen renewed interest lately, especially from ETH treasury companies. In fact, if the trend continues in the mid-term, ETH could cross the $3k psychological level.

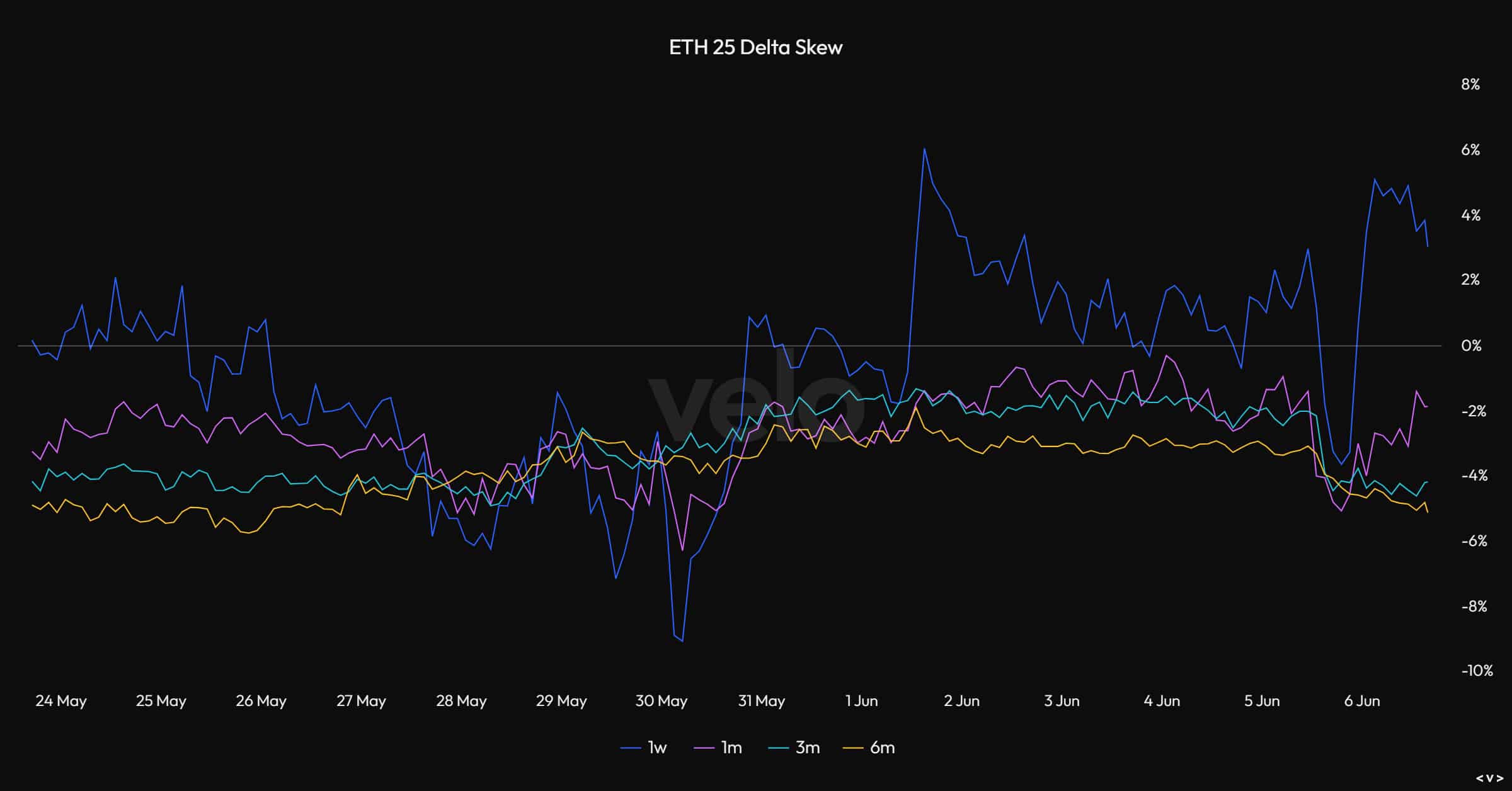

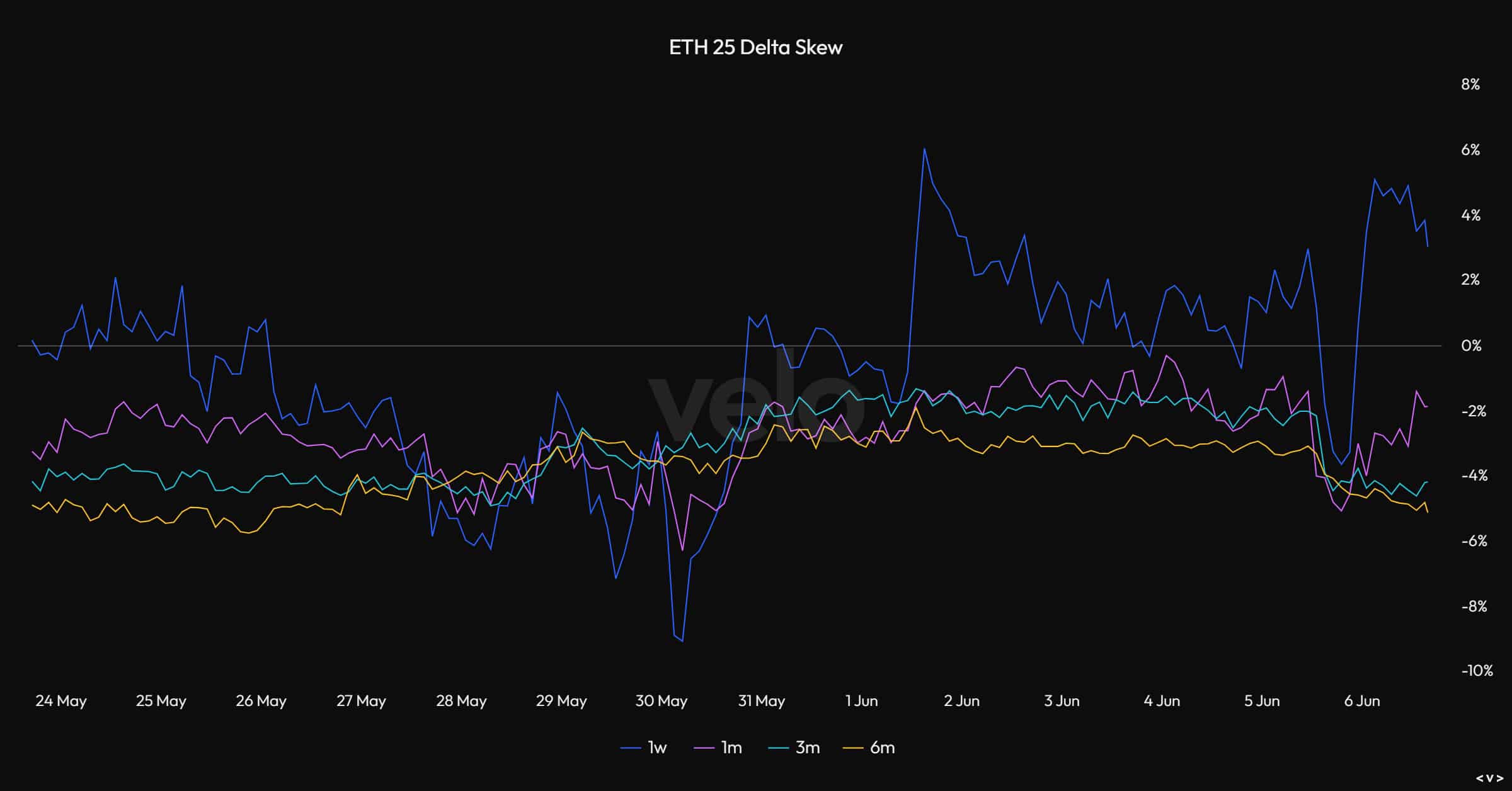

Even so, traders have been cautious in the short term. According to Options market insights, the 25 Delta Skew across nearly all tenors, 1-week (blue) and 1-month (purple), and 3-month (cyan) all dumped on Thursday.

This hinted at a hike in demand for puts (bearish bets or hedging) over calls (bullish bets) – A sign of bearish sentiment.

Source: Velo

In particular, the 1-week and 3-month tenors saw sharp spikes, suggesting traders were heavily hedging in the short term against potential price declines amid the Musk-Trump drama.

Although the 1-week 25 Delta Skew (blue) surged later, it dropped from 5% to 3% at press time. This meant traders were cautious, despite a relief bounce to $2.4k ahead of the weekend.