Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has remained firm above key support levels despite the broader market pullback in recent weeks. While many altcoins have shown weakness, ETH continues to trade above the $2,400–$2,500 zone, signaling strength and positioning itself for a potential recovery. After a volatile start to the year that saw steep declines, analysts are increasingly calling for a breakout, with some suggesting Ethereum could soon reclaim lost ground if current conditions hold.

Related Reading

However, not everyone agrees on the bullish outlook. Some traders warn that Ethereum’s recent consolidation may precede another leg down, especially if resistance near $2,800 remains unbroken. The debate highlights the uncertainty hanging over the market as macro risks and shifting liquidity continue to influence short-term direction.

Top analyst Ted Pillows recently shared his view, noting that Ethereum is still consolidating after a strong May. While this pause may seem neutral, he pointed to rising ETF inflows and growing network activity as leading indicators of renewed demand. According to Pillows, these signals often precede price expansion, suggesting that ETH may just be gearing up for its next move.

Ethereum Holds Firm As Market Volatility Builds Toward A Decisive Move

Ethereum is navigating a critical moment as the broader crypto market faces heightened volatility and mounting uncertainty. Still trading 48% below its all-time high, ETH has shown impressive resilience, holding firm above key support levels even as sentiment wavers. The market remains on edge following renewed tensions between Elon Musk and US President Donald Trump — a dynamic that has triggered risk-off behavior and short-term instability across assets.

Despite the noise, Ethereum continues to show underlying strength. Bitcoin remains stable near its highs, and many altcoins appear to be coiling for potential breakout moves. In this context, the coming weeks could prove decisive for ETH, which has so far managed to consolidate after a bullish May without breaking key structure.

Ted Pillows noted in a recent update that Ethereum is still consolidating, and that’s not necessarily bearish. According to his view, rising ETF inflows and accelerating network activity suggest that renewed demand is quietly building behind the scenes. Historically, these have been leading indicators of a breakout, and ETH looks well-positioned to take advantage.

Momentum is shifting, and bulls are eyeing the $2,800 level as the next key threshold. Reclaiming that level could trigger a move toward $3,000 in June. Beyond that, if macro conditions remain stable, Ethereum could realistically push to $4,000 by Q3 2025.

For now, ETH remains in consolidation mode — but with strength in the fundamentals, technical structure, and on-chain trends, the case for a breakout is growing stronger. The next move will be crucial, not just for Ethereum, but for the broader altcoin market heading into summer.

Related Reading

ETH Holds Mid-Range Structure Amid Continued Consolidation

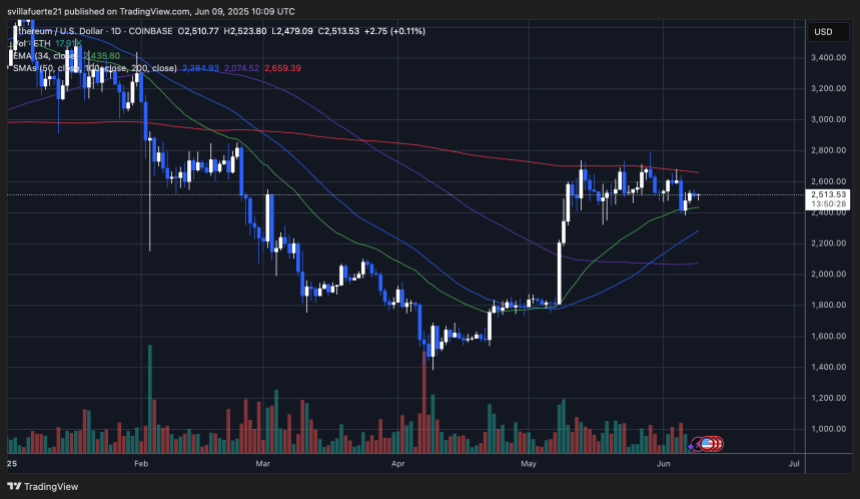

Ethereum continues to trade within a tight range, holding at $2,513 after briefly dipping to $2,479 earlier in the session. As seen on the daily chart, ETH remains in consolidation beneath the key resistance at $2,659, marked by the 200-day simple moving average (SMA), which has capped several upside attempts throughout June. Despite failing to break out, the structure remains constructive.

The 34-day EMA ($2,435.80) and 50-day SMA ($2,284.93) continue to act as dynamic support. ETH recently bounced off the 34 EMA after testing that level for three consecutive days, signaling buyers are still present and defending key zones. Meanwhile, volume remains muted, reflecting indecision and lack of conviction from both bulls and bears.

For now, the $2,430–$2,660 range defines the battleground. A daily close above the 200 SMA would indicate bullish continuation toward the $2,800 level. Conversely, a breakdown below $2,430 could trigger a larger retrace toward $2,200.

Related Reading

Ethereum’s current behavior reflects a market waiting for a catalyst. With rising ETF inflows and steady on-chain activity, momentum could return quickly, but until then, ETH remains trapped in a sideways grind. The next confirmed move out of this range will likely dictate the trend heading into late June.

Featured image from Dall-E, chart from TradingView