Joseph Lubin, a co-founder of Ethereum and chief executive of Consensys, used an X post on 19 June to deliver what may be his most expansive valuation thesis yet for Ether. After praising a research note that likened ETH to “digital oil,” Lubin argued the author still “is not bullish enough” about Ethereum’s ultimate economic footprint.

“This is a very strong piece of work in so many ways,” he began. “Probably everyone who reads this work will learn something and be stoked by the thesis. But this top-tier thought piece has one major structural flaw—a pretty deep structural flaw: it is not bullish enough.”

Ethereum Could Outscale Global GDP

Lubin’s contention is that Ether will underpin a “hybrid human-machine intelligence society” whose value creation compounds far beyond the scope of today’s $113.8 trillion global economy. “It is not a great leap,” he wrote, “to suggest that the value resident on and flowing through Ethereum, which will constitute a large portion of Web3—the re-decentralised—will be orders of magnitude larger than today’s global GDP. Just look at how the energy, chips and data-centre spend is growing exponentially and how AI is accelerating everything.”

He revived the long-standing Bitcoin-versus-Ethereum dichotomy—BTC as “Gold 2.0,” ETH as the native asset of a programmable economy—but pushed it further. “While BTC should be valued as Gold 2.0,” Lubin reiterated, “ETH should be valued on the scale of the emergent decentralised global economy.” That framing, he said, must now be expanded to account for an AI-charged explosion in digital activity that will “grow largely on decentralised rails.”

Lubin devoted half of his post to a thought experiment first sketched on 4 June. “If there was a magical trust-diamond commodity and you could apply chips of this diamond to every transaction, agreement or relationship … how much value would that add? 10 % to global GDP? 100 %? 1,000 %? … The ticker of that commodity is ETH.”

In his view, Ethereum’s unusually decentralised validator set makes Ether “the highest-grade or gold standard of trust on the planet.” That “trust commodity” premium, layered atop the “digital-oil” demand for transaction fees, is what Lubin believes can propel ETH’s fully diluted value far beyond any historical asset benchmark.

Reality Check—Today’s Numbers

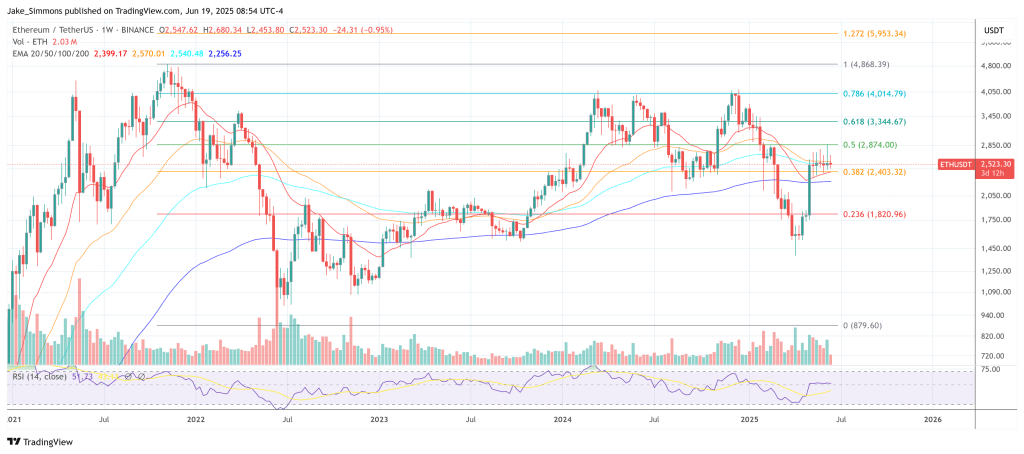

For now, the gap between aspiration and market capitalisation remains yawning. Ether’s float of roughly 120 million coins traded at $2,525 on 19 June, giving the network a market value near $307 billion and representing less than 0.3 % of world output. Yet even that float is shrinking: more than 35 million ETH—about 29% of supply—is now locked in proof-of-stake contracts, an all-time high reached this week.

Lubin regards such supply-side tightening as a preview, not a climax. “Both of these models,” he wrote of the digital-oil and trust-commodity frameworks, “will lead to a giant monetary premium for ETH.”

Whether Ether can plausibly “eclipse” worldwide output—a threshold no single asset has come close to—remains an open question. Lubin’s rhetorical diamond, however, sharpens the stakes: in a future where programmable trust becomes a primary input of production, valuing ETH merely as software gas may prove, to borrow his phrase, “not bullish enough.”

At press time, ETH traded at $2,523.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.