- ETH risks further correction as Futures volume bubble signal an overheated state.

- Ethereum fundamentals suggest that the altcoin is highly undervalued.

Since rallying to hit $2.7k a week ago, Ethereum [ETH] has struggled to maintain its uptrend. After reaching these levels, the altcoin retraced, hitting a low of $2.3k.

Over the past three days, ETH has remained stuck between $2.5 and $2.3k.

The failure to break out of this range has left strategists speculating over Ethereum’s future trajectory.

According to CryptoQuant analyst Shayan, the Ethereum market has been overheating near $2.5k, signaling a potential short-term correction.

In his analysis, Shayan observed that Ethereum’s approach to the critical $2.5K resistance level has led to an overheating state, characterized by a significant surge in trading volume.

The increase in trading volume is mostly driven by profit-taking activity and the presence of resting supply at this significant zone.

Such conditions signal a potential market correction, although in the short term, as the market cools down. A cool down is paving and building a foundation for renewed accumulation.

This renewed accumulation is evidenced by a sustained period of negative exchange netflow. As such, Ethereum’s exchange netflow has remained within negative territory for four consecutive days.

This behavior on the exchanges reflects strong accumulation, as withdrawals outpace inflows.

Is ETH set for correction?

According to AMBCrypto’s analysis, although volume has surged to signal overheated levels, other metrics show a different story.

In fact, the altcoin overly undervalued, and the recent pullback is a healthy retrace.

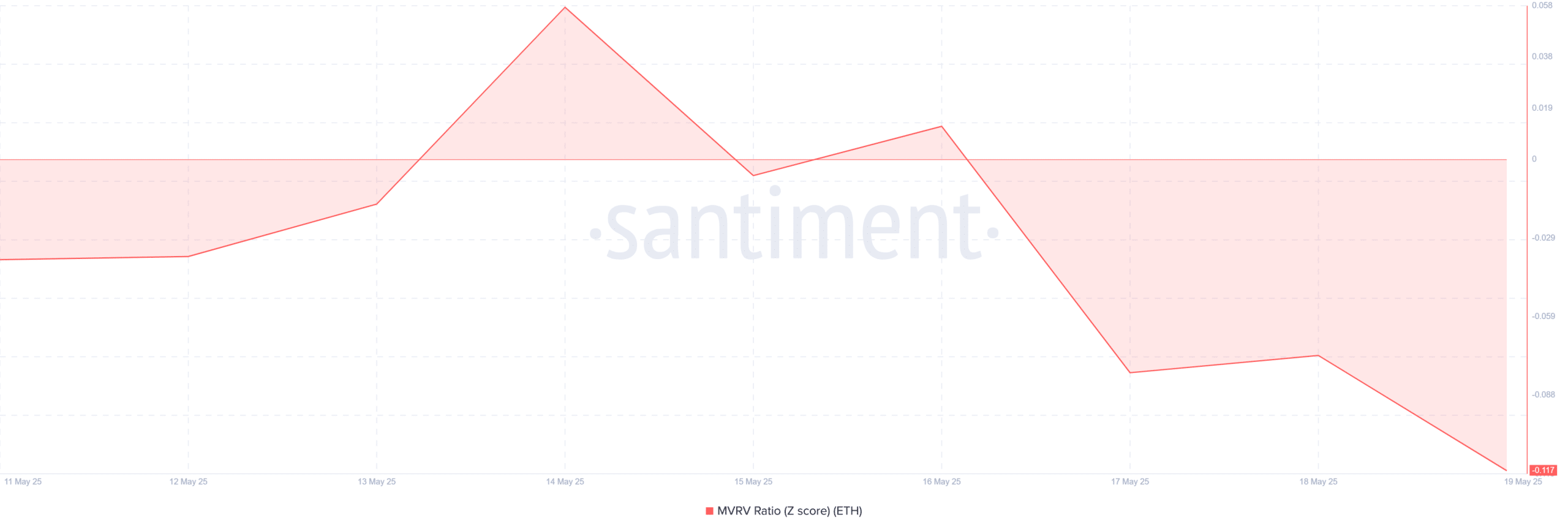

On the contrary, Ethereum is highly undervalued. Looking at Ethereum’s MVRV Z score, this metric has remained within negative territory for four consecutive days.

Over the past week, ETH’s MVRV Z score has only hit a positive value for two days.

Historically, a negative MVRV Z score for Ethereum has coincided with macro bottoms. For instance, these occurred in December 2018, March 2020 and June to December 2022.

In previous cycles, the altcoin held within this territory for a brief period, offering a buy opportunity.

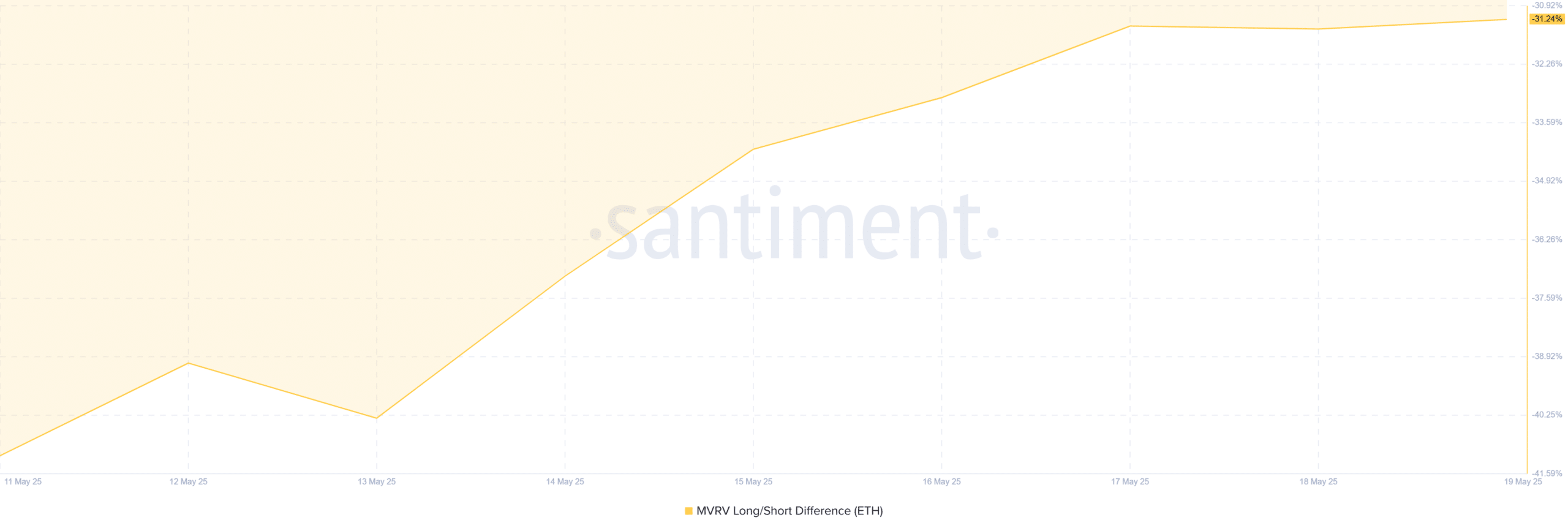

The same can be said when we look at Ethereum’s long-term holders and short-term holders’ MVRV difference. Just like the MVRV, the altcoin MVRV long/short difference has held within negative territory.

Although it has signaled recovery, it’s yet to move outside the negative zone.

Over the past week, Ethereum’s long/short MVRV difference has moved from -41% to -31%. With the metric holding within the negative zone, it suggests that LTH are poorly performing relative to STH.

Thus, short-term holders are now earning more than LTH. With long-term holders mostly at a loss, they are unlikely to sell. The current market conditions are not incentivizing LTHs to close their positions.

Without massive offloading from LTH, the market correction predicted above is unlikely.

What next?

Simply put, although volume has surged, the Ethereum market is still not overheated. On the contrary, the market is highly undervalued, with investors taking this opportunity to accumulate.

At current conditions, only short-term holders are selling.

However, accumulating addresses are absorbing the selling pressure from STH.

Therefore, Ethereum is expected to continue its consolidation phase until fresh demand emerges to drive a breakout above the $1.5k resistance range in the mid-term.

A breakout from the consolidation will strengthen the altcoin to jump towards $1.8k.