Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s recent climb to $105,000 has done little to shake off the worries piling up around its momentum. The world’s biggest cryptocurrency eked out a 0.03% gain in the last 24 hours but still sits 3.5% lower than it did a week ago.

According to analyst Captain Faibik, this mix of flat gains and fading strength could mean traders are buying Bitcoin at the top.

Related Reading

Bearish RSI Divergence Signals Weakness

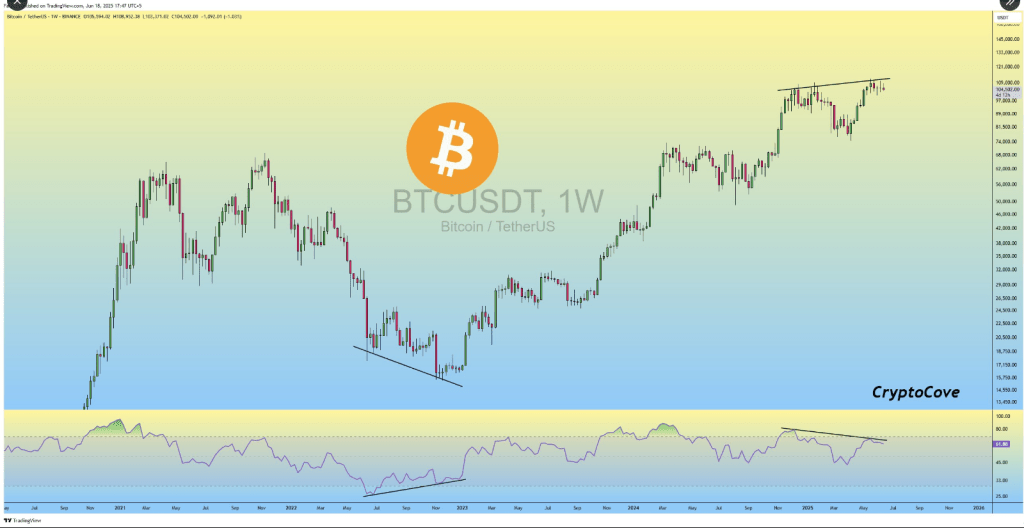

Based on data, the Relative Strength Index (RSI) has drifted downward after peaking near 80, even as Bitcoin’s price pushed to fresh highs. The RSI now sits at 61.88, a clear sign that buyers are losing steam.

Traders often watch for this kind of mismatch—when price goes up but RSI goes down—because it can spell a coming pullback. History shows it doesn’t always lead to a crash, but it does make a correction more likely.

After carving out fresh highs, it feels like Bitcoin has hit its ceiling, according to Fabik, and a pullback into the $92,000–$94,000 zone could be on the cards.

This setup usually sparks a quick correction, so many traders will be watching closely and tightening up their strategies as the market could shift in a hurry.

$BTC is showing a massive RSI Bearish divergence on the weekly chart..!!

It looks like Bitcoin has topped out and is now Ready for a major correction toward the 92–94k Range..📉

Just like it bottomed out at 16k in November 2022,

We bought the dip and now we’re selling the… pic.twitter.com/W25HCAxkIa— Captain Faibik 🐺 (@CryptoFaibik) June 18, 2025

Resistance Levels Keep Price In Check

Bitcoin has bumped into stiff barriers around $108,000 and $109,000, both set on May 19. An ascending trendline from December 2024 has also been capping gains for weeks.

These levels are proving tough to clear. If Bitcoin can’t break through soon, sellers may step in. Faibik points out that hitting these walls and seeing RSI divergence at the same time often marks the high point before a drop.

This Activity Points To Caution

The derivatives market adds another layer to the story. Trading volume in Bitcoin futures and options rose by 1.60%, taking total activity to around $100 billion. Open interest, meanwhile, slid down 1.30% to nearly $70 billion.

This suggests some players are closing their bets rather than piling on new ones. In the past 24 hours, liquidations have wiped out $71 million in long positions. That kind of pain can trigger more sell‑offs if people rush to protect their profits.

Related Reading

Past Patterns Offer Mixed Lessons

Looking back, Bitcoin’s rebound in 2022 followed a different playbook. Back then, price hit a low near $16,000 and built strength even as RSI climbed from oversold levels. That setup led to a strong rally. Today, though, the RSI is nowhere near oversold territory. It’s more of a warning flag than a green light.

Captain Faibik reminds traders that past wins don’t guarantee future results. Conditions now include higher interest rates and deeper institutional interest, which can change how Bitcoin reacts to the same signals.

Featured image from Trade Brains, chart from TradingView