Key takeaway:

Bitcoin (BTC) is generally not regarded as a reliable investment during periods of geopolitical uncertainty, particularly when oil prices spike in response to escalating global tensions. However, historical data suggests that such moments often present compelling buying opportunities for traders prepared to capitalize on market dislocations.

Oil spikes often align with sharp, temporary Bitcoin price corrections

In the face of imminent conflict or instability, investors typically rotate into short-term government debt and cash, favoring safety over volatility. Nevertheless, Bitcoin has historically outperformed in the week following abrupt oil price surges, such as the recent rally to $77 per barrel on Friday.

A review of the 15-minute price chart reveals an inverse relationship between Bitcoin and oil. As WTI crude rose 19% between Wednesday and Friday, Bitcoin declined from $110,200 to $102,800. This pattern aligns with the prevailing view of Bitcoin as a risk-on asset, not a defensive hedge. Yet, a broader time frame offers different insights.

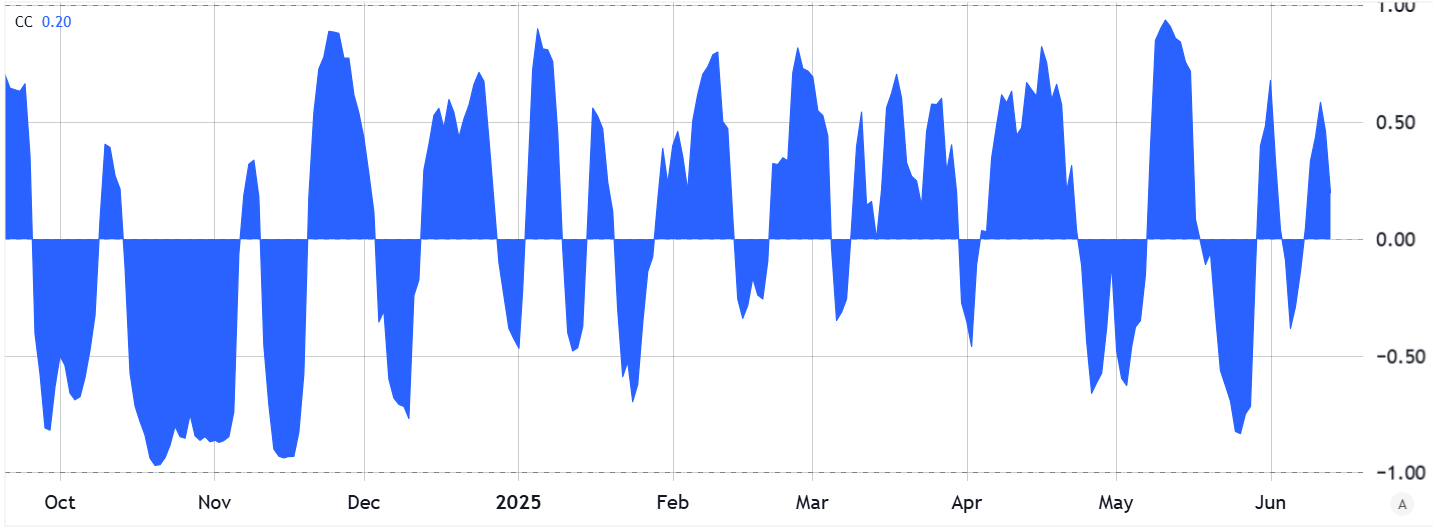

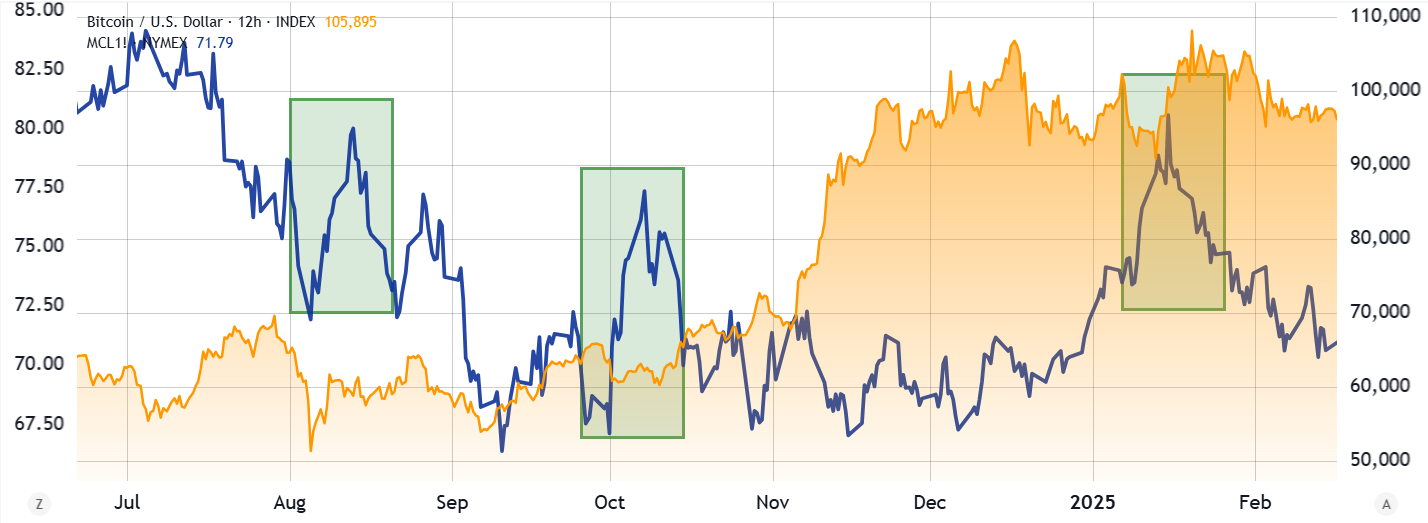

Over the long term, data shows no consistent correlation between Bitcoin and oil prices, with the relationship fluctuating considerably. Still, episodes of extreme oil price appreciation have coincided with sharp Bitcoin corrections—three times in the past year alone. Each instance was followed by a rebound in Bitcoin’s price, with gains ranging from 16% to 24% within eight days of the initial drop.

In the most recent instance, on Jan. 15, 2025, oil surged to $80.50 from $72.50 just six days earlier. The spike coincided with a Bitcoin drop to $89,300 on Jan. 13, followed by a 22% rally to $109,300 by Jan. 20. The move came after the United States imposed sanctions on Russia’s oil sector, while US crude inventories declined for eight consecutive weeks.

Earlier, on Oct. 8, 2024, oil prices jumped to $77.50 from $68.00 the week before. Bitcoin initially corrected to $58,900 on Oct. 10 but then advanced 16% over the following eight days. The rally to $68,960 rewarded traders who capitalized on the volatility triggered by the Oct. 7 terrorist attacks in the Middle East.

Related: Panic or opportunity? What crypto capitulation tells smart investors

A similar pattern occurred on Aug. 13, 2024, when oil rose to $80 from $74 after Libya temporarily shut down key oil fields, reportedly due to mobilization by armed groups. Bitcoin fell to $56,150 by Aug. 15 but rebounded 16% within days, reaching $65,000 by Aug. 23.

While there is no guarantee the trend will persist, oil prices have once again climbed to five-month highs. Historical data suggests that Bitcoin’s current level near $102,800 could present another attractive entry, potentially targeting a 16% gain to $119,200 by June 21.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.