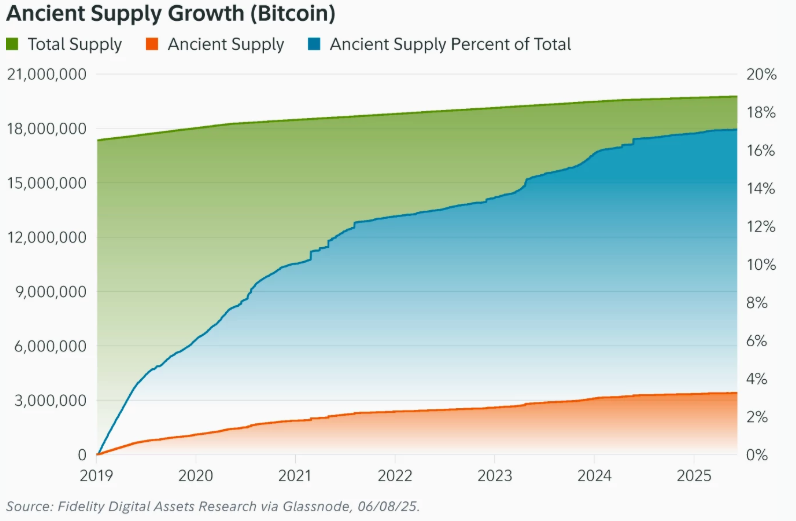

Fidelity Digital Assets released a new report that reveals that for the first time in history, more bitcoin is entering “ancient supply,” which refers to coins that have remained unmoved for 10 years or more, than are being mined.

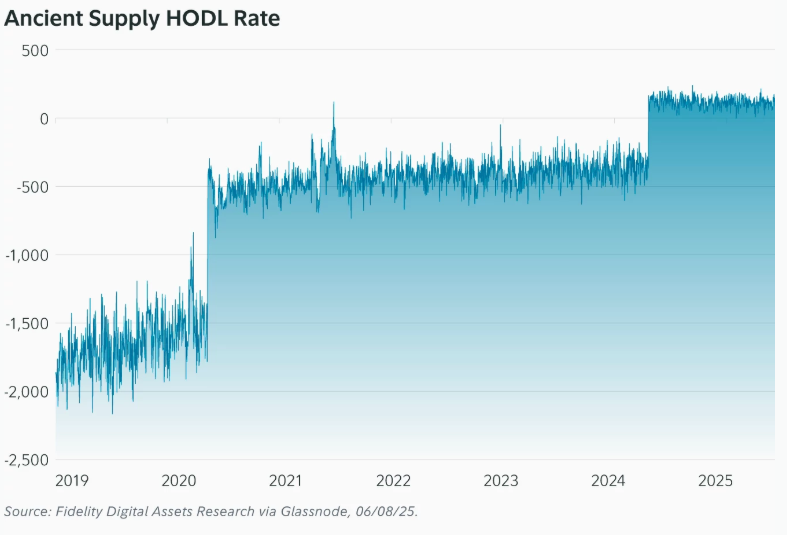

As of June 8, an average of 566 BTC per day is crossing the 10 year threshold, while only 450 BTC is being issued daily following the 2024 halving. 3

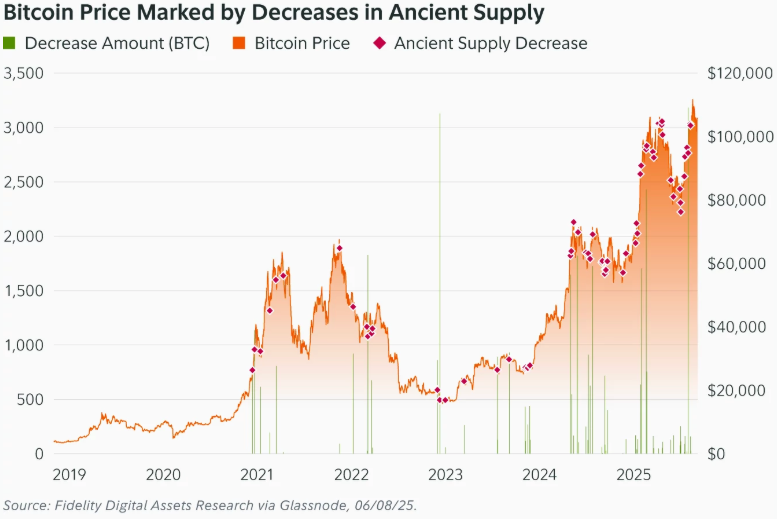

“The share of ancient supply also tends to increase each day, with daily decreases observed less than 3% of the time,” the report says. “In contrast, that number increases to 13% when the threshold is lowered to bitcoin holders of five years or more.”

Bitcoin’s ancient supply has grown since January 1, 2019, when Satoshi Nakamoto became the first 10 year holder. Today, over 3.4 million BTC fall into this category, worth more than $360 billion. Around 1/3 is believed to belong to Nakamoto.

Despite their rising value, long-term holders are not cashing out. Ancient supply makes up over 17 percent of all bitcoin, and that share continues to grow.

Since the 2024 halving, the number of coins entering ancient supply has consistently outpaced the number of new coins being mined, according to the report. This shift highlights growing long-term conviction among holders and reflects a broader tightening of bitcoin’s liquid supply.

Following the 2024 U.S. election, ancient supply declined on 10% of days, which is nearly four times higher than the historical average. Movement among the holders was even more pronounced, with daily declines occurring 39% of the time.

To better track this trend, Fidelity uses a metric called the ancient supply HODL rate. It measures how many coins are entering the 10 year category each day, adjusted for new issuance. This rate turned positive in April 2024 and has remained that way, reinforcing the long-term supply shift.

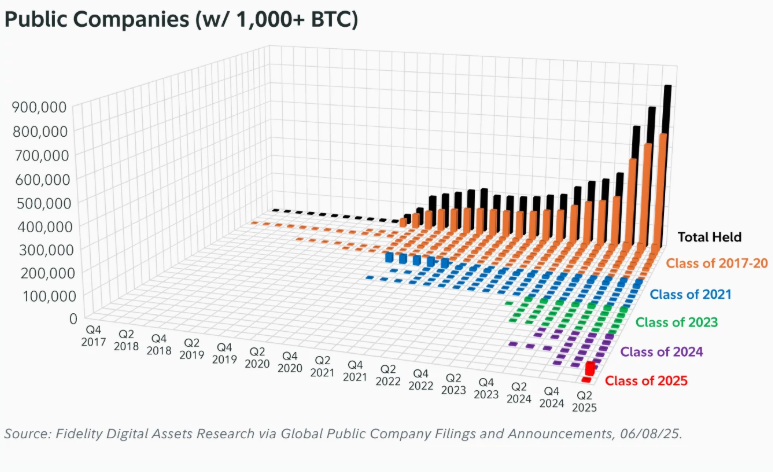

Looking ahead, Fidelity Digital Assets projections that ancient supply could reach 20 percent of total bitcoin by 2028 and 25 percent by 2034. If public companies holding at least 1,000 BTC are included, it could reach 30 percent by 2035.

As of June 8, 27 public companies hold more than 800,000 BTC combined, according to the report. This growing institutional presence may further tighten supply and increase the influence of long-term holders over time.