Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has continued to hover above the $100,000 mark over the past few days, and its price action has stabilized around $105,000 in the wake of recent market tensions and despite inflows into Spot Bitcoin ETFs.

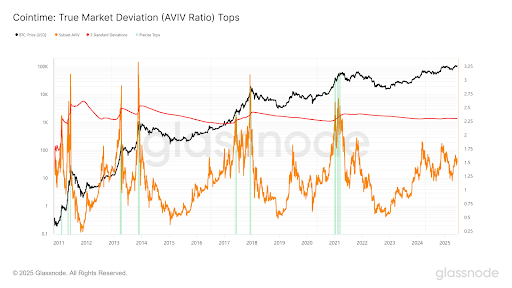

A new analysis shared by crypto market commentator Gert van Lagen suggests that this current phase is going to precede an explosive move similar to those seen in previous market cycles. Backing his prediction with historical data and Glassnode’s AVIV Ratio chart, the analyst noted that the current on-chain structure echoes moments before Bitcoin’s major rallies in past bull markets.

AVIV Ratio Flashes Familiar Pattern Before Market Top

Bitcoin’s price volatility has slightly cooled since the initial surge to a new all-time high above $111,800 in May, and the latest candlestick structure suggests it may be preparing for another leg higher.

Related Reading

Taking to the social media platform X, Gert van Lagen revealed a Bitcoin price prediction that centers around the true market Deviation metric known as the AVIV Ratio. This orange-colored line on the chart tracks a specific deviation in Bitcoin’s market behavior and has always crossed a red line denoting +3 standard deviations at or just before cycle tops.

The current AVIV behavior can be compared to previous price points before market tops in previous cycles. For instance, in 2013, the AVIV Ratio flagged a major rally when Bitcoin was trading near $200, shortly before the price pushed past $1,200. In 2017, the metric behaved similarly when Bitcoin was trading at $3,700 and later peaked near $20,000. The current AVIV Ratio can also be compared to when Bitcoin was priced at $13,000 in the 2021 bull market run, before its surge to an all-time high of $69,000.

According to the analyst, today’s AVIV ratio level is closely aligned with those previous mid-cycle breakouts. The current ratio has not yet crossed the red +3σ line, which the analyst refers to as the cycle top trigger. As such, its current reading suggests Bitcoin may be in the early phase of a major bull market expansion. If history repeats itself, a 3x move from today’s levels would be a standard price move in line with previous price action.

$300,000 Target Within Sight If AVIV Behavior Holds

Crypto analyst van Lagen stops short of calling for an immediate top, but his analysis implies that Bitcoin could be preparing for a new parabolic surge to the upside. Using the AVIV model as a reference, a conservative 3x multiplier on the current Bitcoin price places a possible target around $300,000.

Related Reading

At the time of writing, Bitcoin is trading at $104,997, having decreased by 1.4% in the past 24 hours. This decline has brought its price down from an intraday high of $106,795 back into its consolidation range around $105,000.

Featured image from Pixabay, chart from Tradingview.com