Memecoins promoted by political figures like Donald Trump, lax regulations, and crypto court cases abandoned by US regulators have kicked off a crypto “crime supercycle,” say a pair of blockchain crime investigators.

Blockchain investigator ZachXBT posted to X on Thursday that crypto has historically been ripe for abuse, but that has “noticeably increased since politicians launched memecoins and numerous court cases were dropped, further enabling the behavior.”

He claimed crypto influencers and key thought leaders face “zero repercussions” for scamming their followers.

“That said, there’s never been a worse time to be doing black hat, phishing, social engineering, robberies, vs. gray hat activity when the current environment is favorable,” ZachXBT added.

Slow regulation plays a factor

A lack of regulation, failing to clamp down on projects that didn’t disclose paid ads and other similar behavior have also contributed to the so-called supercycle, according to ZachXBT.

“If they had spent time regulating it instead of going after open source developers or blue chip decentralized protocols, it’s only prevalent because there’s never really been repercussions,” he said.

Over $2 billion was lost to crypto hacks in the first quarter of 2025, with phishing scams making up $96 million, and rug pulls accounting for over $300 million, cybersecurity firm Hacken said in its April report, shared with Cointelegraph.

Change unlikely while criminals make money

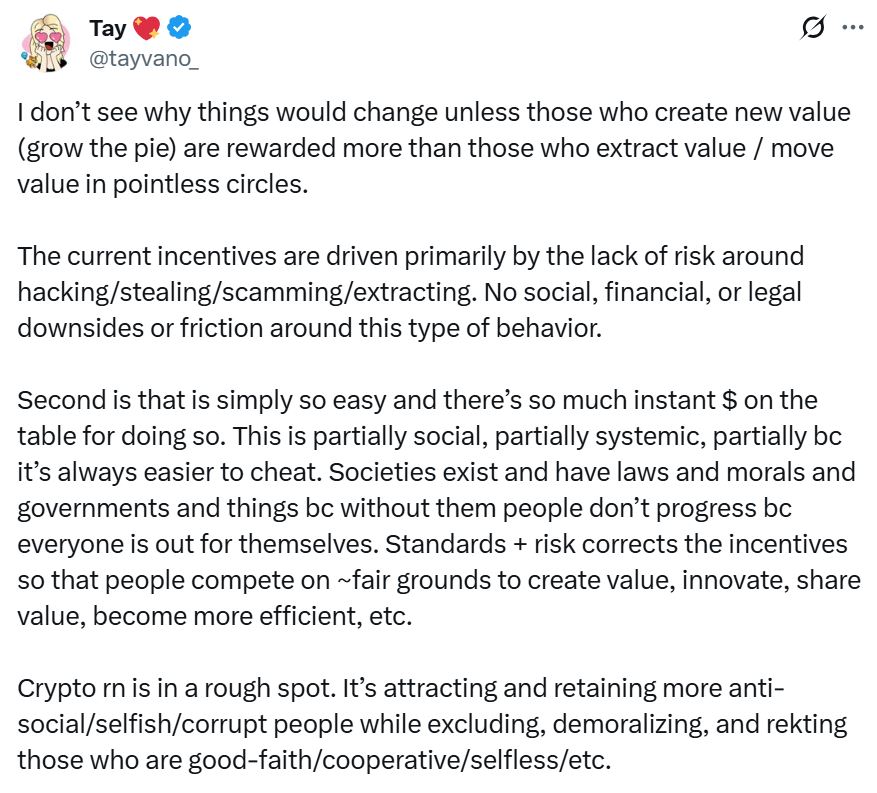

Blockchain sleuth Taylor Monahan also chimed in, saying scammers operating in the space are unlikely to change while they are still being rewarded through large profits.

“No social, financial, or legal downsides or friction around this type of behavior. Second is that is simply so easy and there’s so much instant [money] on the table for doing so,” Monahan said.

Monahan thinks the crypto space is in a “rough spot” because it’s retaining too many hackers and scammers.

“Most have gone basically all-in over the last two cycles, e.g., romance scams, [North Korea], malware as a service. Ransomware would be the biggest losers if crypto ceased to exist tomorrow,” Monahan said.

Related: North Korea targets crypto workers with new info-stealing malware

The law catches up with some scammers

There are scammers in the crypto space facing the law for their crimes. In a Wednesday notice, officials with the US Department of Justice announced the seizure by the Secret Service of more than $225 million linked to crypto investment scams.

In May, a New Zealand man was arrested in connection with a global crypto fraud operation that allegedly stole 450 million New Zealand dollars ($265 million).

Magazine: Influencers shilling memecoin scams face severe legal consequences