Ethereum is navigating intense volatility as global tensions rise, particularly with the escalating conflict between Israel and Iran. Markets are on edge amid growing fears that the United States could become directly involved, further increasing uncertainty across risk assets. Despite these headwinds, Ethereum has managed to hold above the $2,500 level, showing resilience even as price action remains stuck within a range that began forming in early May.

The $2,700 level stands out as a key resistance that bulls must reclaim to spark momentum toward the $3,000 mark. However, repeated rejections from this area signal that buyers are hesitating, possibly due to the broader market’s caution and unclear macroeconomic outlook.

Top analyst Ted Pillows highlighted a notable development: despite heightened global tensions, the ETH/BTC pair is up on the weekly timeframe. This suggests relative strength from Ethereum and may indicate that the worst of the downside could be behind it. If the pair continues outperforming Bitcoin, it could signal the beginning of a new altcoin trend — but much depends on whether Ethereum can reclaim and sustain levels above $2,700 in the face of growing geopolitical risks and tightening market conditions.

Ethereum Eyes Breakout As ETH/BTC Chart Shows Strength

Ethereum is positioning for a decisive move after more than six weeks of consolidation just below the $2,800 level. Price action has been trapped between $2,500 and $2,800, with bulls repeatedly testing the upper boundary while bears continue to defend it. This prolonged standoff suggests a build-up of pressure that could soon erupt into a major directional shift.

Bulls are attempting to reclaim control as the broader crypto market stabilizes, but uncertainty remains elevated. The ongoing conflict between Israel and Iran, along with the looming risk of US involvement, continues to weigh heavily on sentiment. Investors are cautiously watching for clarity, and until geopolitical risks ease, Ethereum and other risk assets are likely to remain in a sideways trend.

Ted Pillows points to the ETH/BTC weekly chart as a leading signal. According to his analysis, despite extreme macro stress, ETH/BTC is climbing — a sign that Ethereum has likely bottomed relative to Bitcoin for this cycle. Historically, such bottom formations often precede strong altcoin rallies.

Pillows suggests that once macro conditions begin to stabilize, Ethereum could mirror its explosive May performance. A breakout above $2,800 would confirm bullish momentum and potentially ignite a parabolic move toward the $3,200–$3,500 range. For now, the $2,800 resistance remains the critical barrier that must be flipped into support to validate any breakout scenario.

ETH Consolidates At Critical Support

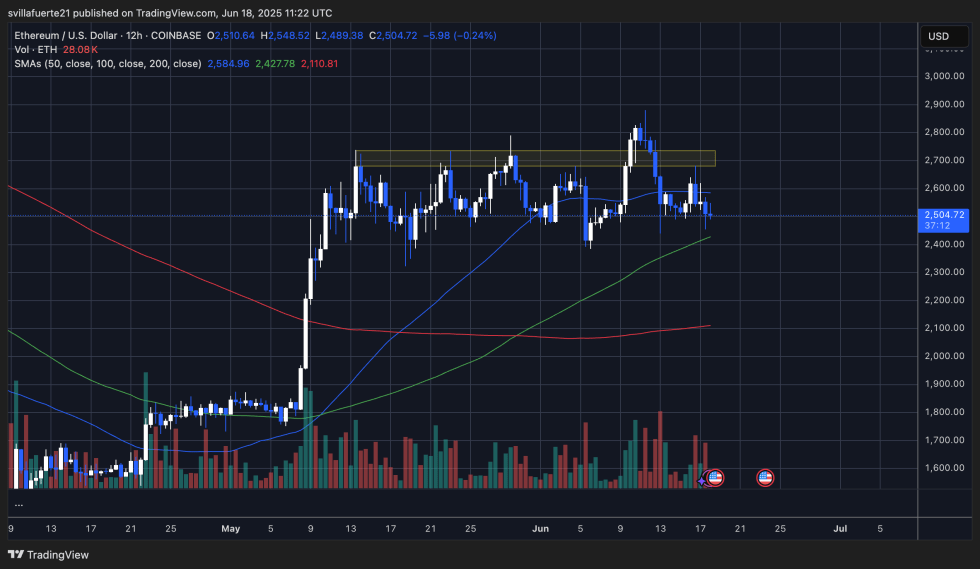

The 12-hour chart for Ethereum (ETH) shows continued consolidation within a well-defined range between $2,500 and $2,800. ETH recently tested the lower boundary of this range around $2,500 and held, suggesting bulls are still defending key demand levels. However, upside momentum has stalled multiple times at the $2,675–$2,800 resistance zone, marked by the yellow highlighted region on the chart.

Volume has remained elevated during recent attempts to break out, but each rally has met strong selling pressure, especially as price approaches the $2,750 area. This indicates bears are actively protecting that level. The 50-day and 100-day moving averages are starting to flatten, reflecting the lack of directional bias, while the 200-day MA remains comfortably below current price — a long-term bullish sign if support continues to hold.

The price action suggests that Ethereum is coiling for a decisive move. If ETH loses the $2,500 level with strong volume, a drop toward the 100-day moving average around $2,427 becomes likely. On the other hand, a clean break and close above $2,800 could open the door to a fast move toward $3,000–$3,200. For now, all eyes are on the range boundaries as market participants await resolution.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.