- Binance recorded 384K USDT transactions on Tron, signaling increased platform and network usage.

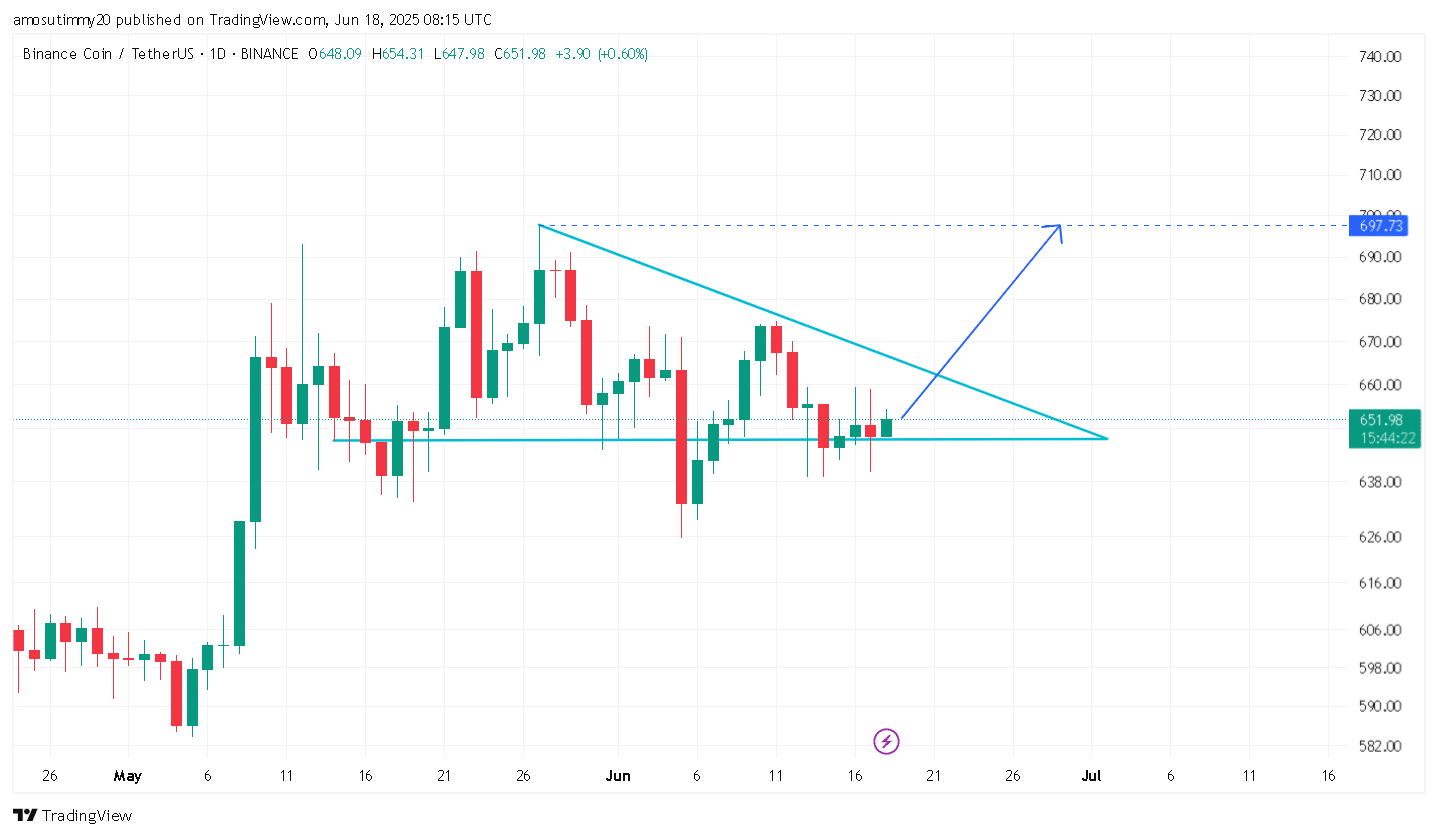

- BNB trades in a bullish wedge and could target $690 if it breaks resistance with strong volume.

Binance Coin [BNB] traded lower by 1.5% over the past 24 hours and slipped 2.86% on the weekly chart. However, the modest drop hasn’t shaken investor conviction—on-chain growth continues to flash signals of strength.

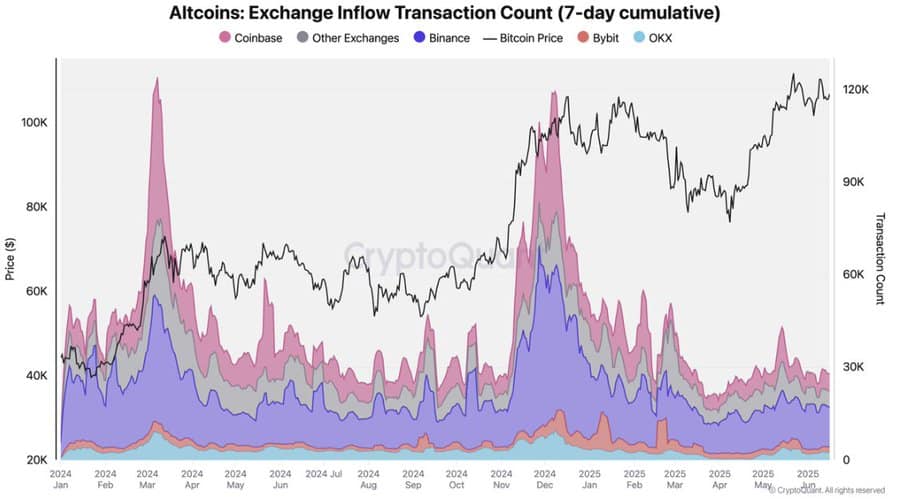

Binance inflows go parabolic—what’s cooking?

CryptoQuant revealed a significant surge in crypto inflows, with the majority associated with Binance—the cryptocurrency exchange behind the BNB token.

According to the report, Binance recorded 384,000 USDT transactions on Tron, surpassing the combined transaction volume of Bybit and HTX.

Typically, such a high inflow indicates increased usage of BNB in processing transactions both on the platform and across the Binance Smart Chain.

The analysis revealed that market participants likely interpreted this as a bullish indicator, as the number of on-chain addresses surged notably.

The number of new on-chain addresses surged over 17%, climbing past 802,800 at press time. However, these new addresses did not perform major transactions, as Transaction Count analysis showed a slight 1.2% decline.

One possibility is that these new addresses purchased BNB during a broader market cooldown, which contributed to the drop in transaction activity.

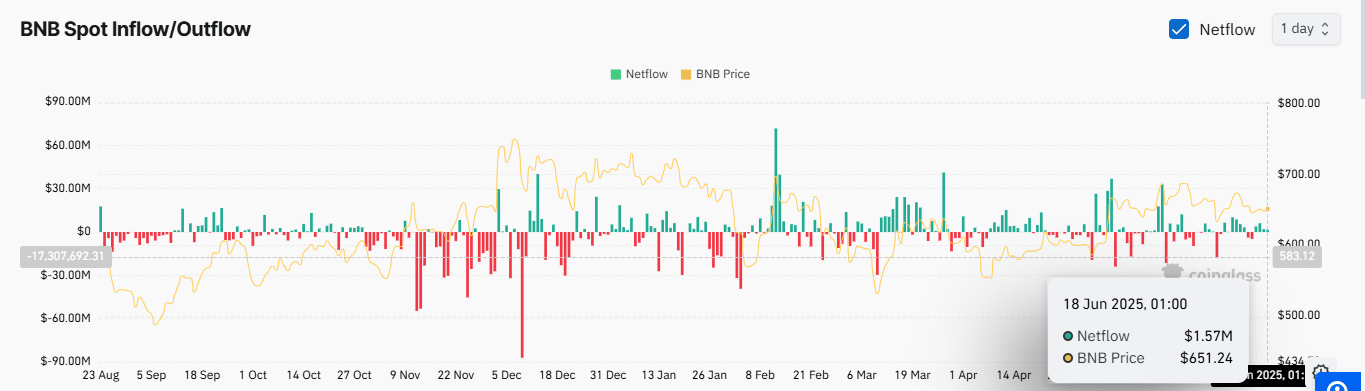

Spot sellers vanish as holding gains favor

Spot market activity has continued to decline over the past few days. On the 16th of June, sell-side activity was near $6M. By press time, it shrank to just $1.57M.

When the volume of an asset sold drops under conditions of rising adoption, it typically suggests that investors prefer to hold rather than sell.

Meanwhile, derivatives traders stayed confident. The OI-Weighted Funding Rate remained positive, suggesting longs paid to hold their exposure.

BNB market movement stays strong

Market analysis shows BNB currently trading within a bullish pattern defined by horizontal support and a descending resistance line.

Despite selling pressure, the asset continues to push upward, with a green candle forming after a bounce off the support level.

If BNB reaches the resistance line and gains sufficient momentum, it could break out and rally toward $690, based on historical trends.