- Retail and smart money sentiment align, with buy pressure focused near the $0.61 support.

- Funding Rates rise despite falling Open Interest, showing cautious optimism in derivatives.

Cardano [ADA] sentiment has turned decisively bullish across both retail and smart money, reflecting a rare alignment between the two cohorts.

According to Market Prophit data, the crowd sentiment score sat at 1.52, at press time, while smart money tracked slightly lower at 0.72—both comfortably in positive territory.

Additionally, the 90-day Spot Taker CVD remains buy-dominant, further reinforcing this optimism, as per CryptoQuant analytics.

This shift comes at a crucial time, as Cardano traded at $0.6218 after dropping 3.08% in the past 24 hours, at press time. Therefore, sentiment could become a driving force if price action respects critical technical levels.

ADA approaches critical demand zone

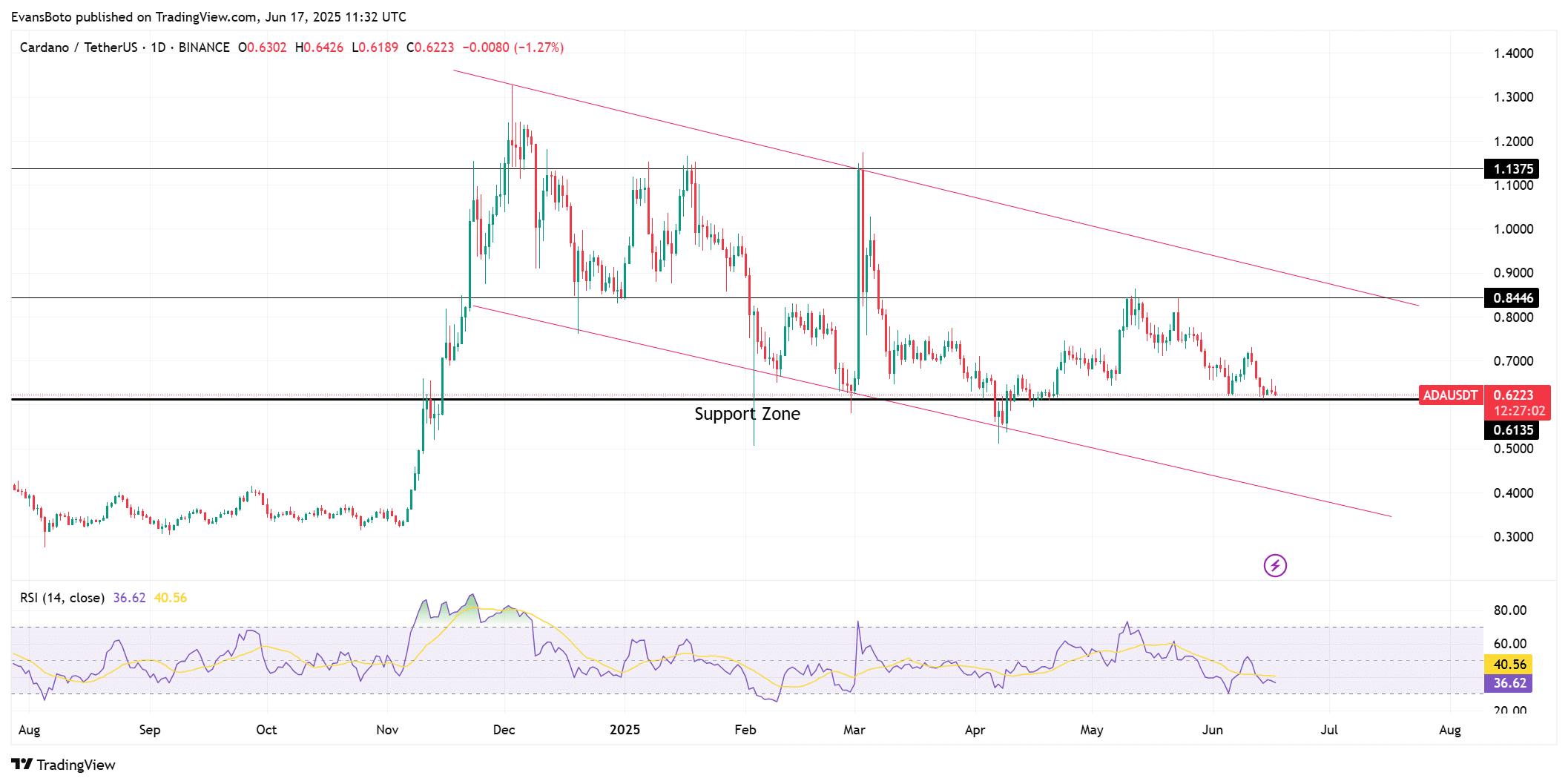

ADA is hovering just above a key support zone near $0.61, a level that has held since early May. The asset remains locked in a broader descending channel, and price has so far respected the lower boundary.

Despite the drop, RSI indicators showed potential signs of reversal, with the 14-day RSI printing a reading of 36.62. This reflects growing weakness, but also potential opportunity.

Therefore, if bulls capitalize on sentiment strength and defend the $0.61 level, a bounce back toward $0.84 becomes increasingly viable within the channel.

On-chain derivatives data paints a mixed picture. Open Interest has declined 3.35%, now sitting at $746.81 million. This drop suggests some leveraged traders may be de-risking positions.

However, Funding Rates have turned positive, as at the time of writing, the OI-Weighted Funding Rate was at 0.0096%. This meant that longs were willing to pay to maintain exposure, reflecting bullish conviction despite lower volume.

Stablecoin outflows hint at liquidity challenges

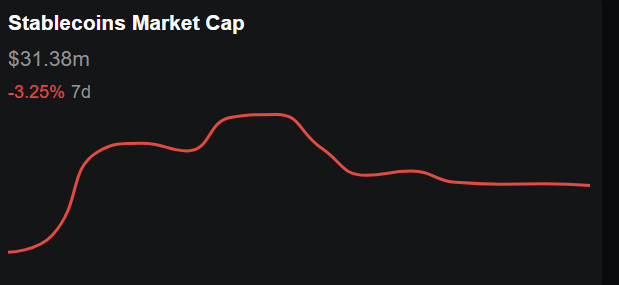

Market-wide liquidity is tightening, with the total stablecoin market cap declining by 3.25% over the past week to $31.38 million.

Despite this downturn, Cardano (ADA) is defying the trend—taker buy dominance remains strong, indicating persistent buying interest.

This divergence highlights ADA’s ability to attract localized demand even as broader crypto inflows wane.

If stablecoin inflows rebound and price support holds, ADA could be well-positioned for a bullish breakout.

Binance Futures data reveals a significant long bias among traders. As of June 17, 73.54% of ADAUSDT perpetual accounts remain long, while only 26.46% are short, resulting in a Long/Short Ratio of 2.78.

This indicates that the majority of traders expect a rebound from current levels.

However, this optimism also increases the risk of a long squeeze if the $0.61 support breaks. Therefore, the coming days will test the resilience of bullish conviction in the derivatives market.

Can bullish conviction hold ADA above key support?

Sentiment, buy pressure, and technical structure all align at a crucial point for ADA. If bulls manage to hold the $0.61 support zone, a reversal toward the upper channel resistance is possible.

However, any breakdown may invalidate this outlook and shift sentiment rapidly bearish. The next few sessions will likely determine if ADA’s bullish bias holds true or fades under pressure.