The median cost of mining a single Bitcoin is estimated to have climbed above $70,000 in the second quarter as miners navigate a rise in network hashrate and energy prices.

According to a report on Monday from Bitcoin mining research firm TheMinerMag, the median cost of producing Bitcoin (BTC) already rose from $52,000 in the last quarter of 2024 to $64,000 in Q1 2025. This is expected to increase by over 9% in Q2.

“Direct production costs are expected to surpass $70,000 in the current quarter,” TheMinerMag said in its May/June industry update.

Bitcoin’s rising price is giving miners breathing room

A rise to $70,000 would mark a near 9.4% increase, potentially pressuring less efficient Bitcoin miners as their profit margins shrink.

With Bitcoin trading at around $107,635, most miners still have a sufficient buffer — though the production cost estimates don’t include the depreciating value of the mining rigs and factors in Bitcoin earned from machines that are rented out to clients, among other things.

Keeping fleet costs low is a top priority

With mining production costs on the rise, public companies have been focused on keeping their operations as efficient as possible, particularly when it comes to their fleet hashcost — the cost of computing power to mine Bitcoin — TheMinerMag noted.

In Q1, the median fleet hashcost from public miners held steady at approximately $34 per petahash per second (PH/s). However, some firms, including Terawulf and Bitdeer, saw production costs rise by over 25%, according to the report.

Terawulf said the increase was primarily due to rising energy costs, which spiked to $0.081 per kilowatt-hour (kWh) in Q1, nearly double the $0.041 per kWh reported in Q1 2024.

Mining stocks split as investors reward revenue diversification

Meanwhile, Bitcoin mining stocks have been diverging as investors increasingly favor firms with revenue streams beyond Bitcoin mining, TheMinerMag said.

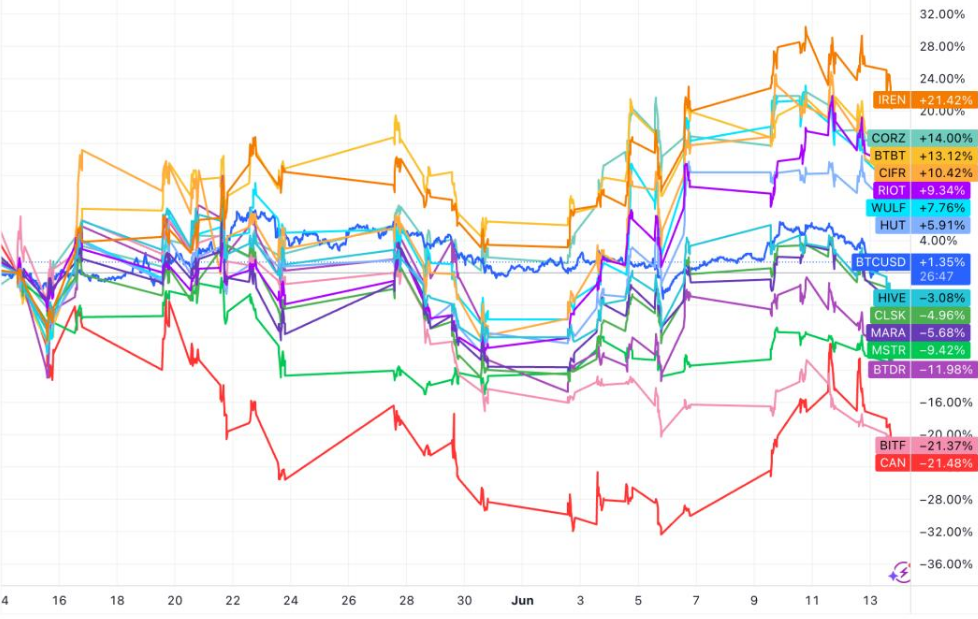

While Bitcoin increased 1.35% between May 4 and June 13, IREN (IREN) soared 21.4% over the same time frame, with Core Scientific (CORZ), Bit Digital (BTBT), and Cipher Mining (CIFR) also posting double-digit gains.

In contrast, Canaan (CAN) and Bitfarms (BITF) have been the worst performers, each falling by over 21%.

Related: Early Bitcoin adopter says BTC could have another 100X cycle

“The spread between the top and bottom-performing mining equities has widened significantly, underscoring growing investor focus on revenue diversification beyond Bitcoin mining.”

AI hosting and high-performance computing services are among the main operations that Bitcoin miners have ventured into in recent months.

Magazine: Baby boomers worth $79T are finally getting on board with Bitcoin