Key points:

XRP’s (XRP) price is up 2% on June 16 to reach an intraday high of $2.20, mirroring similar upside moves elsewhere in the cryptocurrency market.

Traders pushed the price higher despite deepening geopolitical tensions in the Middle East as optimism surrounding the conclusion of the SEC vs. Ripple lawsuit and favorable chart technicals backed XRP’s upside.

XRP price recovers with crypto market rebound

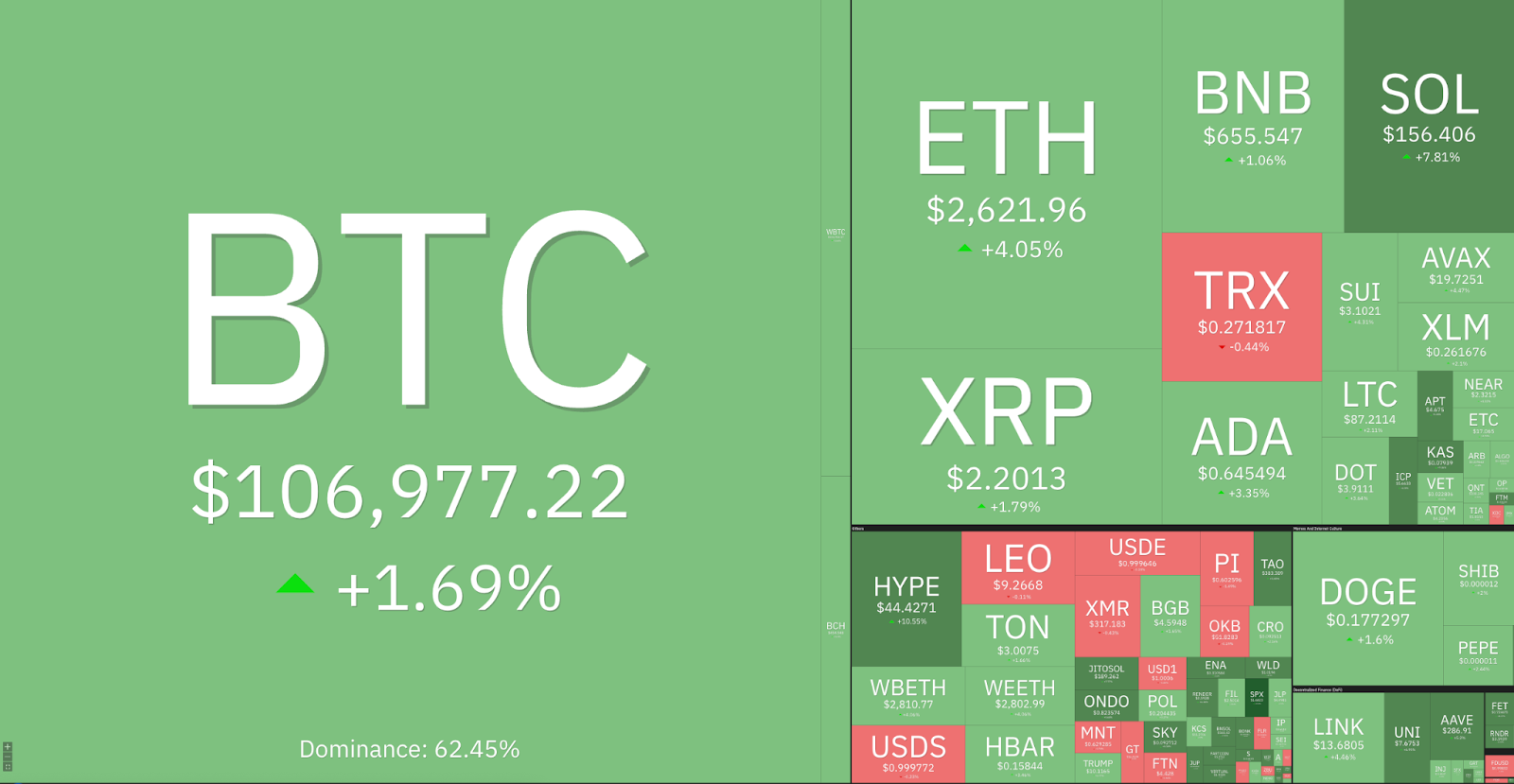

The bullish sentiment was not only exclusive to XRP, as crypto prices also recovered across the board, buoyed by Bitcoin’s weekly close above $105,000. BTC was up 1.7% on the day to trade around $107,000 at the time of writing.

Related: Trident Digital to create XRP treasury of up to $500M

Ether (ETH) had gained more than 4% over the last 24 hours to trade just above $2,600. Its layer-1 rival, SOL (SOL), led the gains with an 8% daily surge to trade at $156. The global crypto market capitalization had increased by 2.2% to $3.34 trillion at the time of writing.

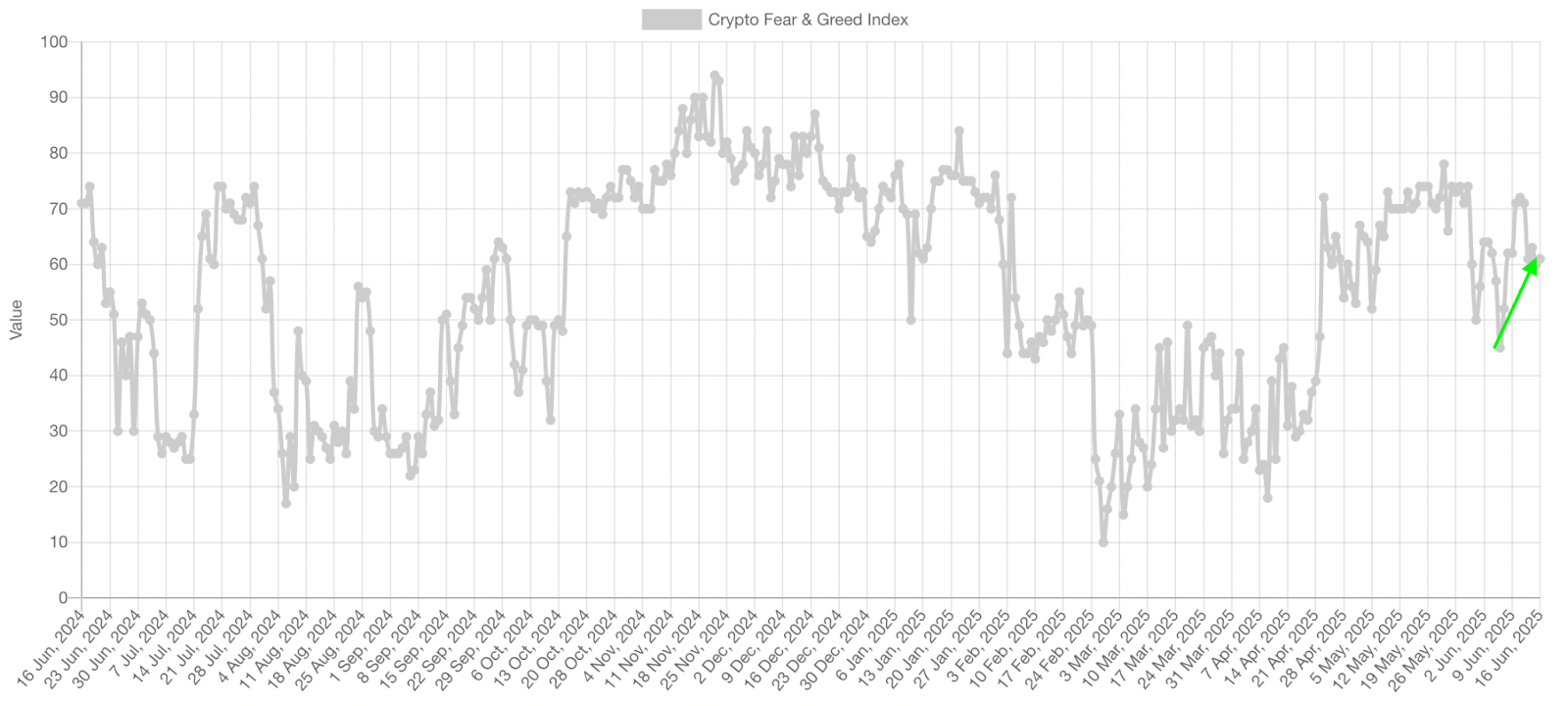

This is accompanied by a significant improvement in market sentiment over the last 10 days. The recent market drop saw the Crypto Fear & Greed Index — a metric that tracks “emotions and sentiments” around cryptocurrencies — drop to 61 on June 16 from 71 on June 10 as XRP price fell to $2.08.

The index remains in the “greed” zone at 61 after rising from “neutral” on June 6. Like RSI, this metric indicates plenty of room for upside before entering overbought territory or “extreme greed.”

Ripple-SEC joint motion sparks optimism

Renewed optimism surrounding the ultimate resolution of Ripple’s lengthy legal dispute with the US Securities and Exchange Commission, providing crucial regulatory clarity, will likely boost XRP price, too.

On June 12, Ripple and the SEC filed a joint motion requesting Judge Analisa Torres to approve a settlement that would lift a $125 million penalty against Ripple, with the firm paying $50 million to the SEC and the rest retained.

🚨 JUST IN: The SEC and Ripple have filed for a joint motion to dissolve the injunction in their ongoing case.

They also proposed to split the $125M civil penalty, with $50M going to SEC and $75M to Ripple. pic.twitter.com/7l5TRcHz3N

— Cointelegraph (@Cointelegraph) June 13, 2025

This follows a May 15 denial of a similar motion due to procedural issues, but the refiled request addresses those concerns, raising hopes for a final resolution.

Attorney John Deaton predicts a 70% chance that Judge Analisa Torres will approve this. In a June 13 post on X, Deaton said:

“There is a 70% chance that Judge Analisa Torres will approve the proposed settlement, despite some legal experts finding the joint motion’s arguments less convincing.”

If granted, it will bring financial relief and clarity to Ripple, enhancing its market position and potentially boosting demand for XRP.

XRP price eyes 40% gains next

The weekly chart shows XRP (XRP) price trading with a falling wedge pattern, with the price facing resistance from the upper trendline at $2.25.

A weekly close above this area will clear that path for XRP’s rise toward the wedge’s target at $3.12, representing a 40% increase from the current price.

Falling wedges are typically bullish reversal patterns, and XRP’s consolidation within the pattern’s trend lines suggests that the uptrend will likely continue. The price also rides above all the major moving averages, a key trend signal.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.