Bitcoin’s (BTC) mining difficulty fell slightly on Saturday after hitting an all-time high of 126.9 trillion on May 31 at the start of the previous difficulty adjustment period.

The Bitcoin mining difficulty level currently stands at roughly 126.4 trillion, according to data from CryptoQuant.

Higher mining difficulty and network hashrate, which is a separate but related measure of the total computing power securing the Bitcoin protocol, both translate into increased miner competition and higher production costs.

Miners continue to face financial pressures from the reduced block reward following the April 2024 halving, rising operational costs, and increased mining difficulty, which have changed the calculus for mining companies struggling to remain profitable.

Related: Solo Bitcoin miner bags $330K block reward despite record difficulty

Some publicly traded mining companies buck the trend and expand operations, despite headwinds

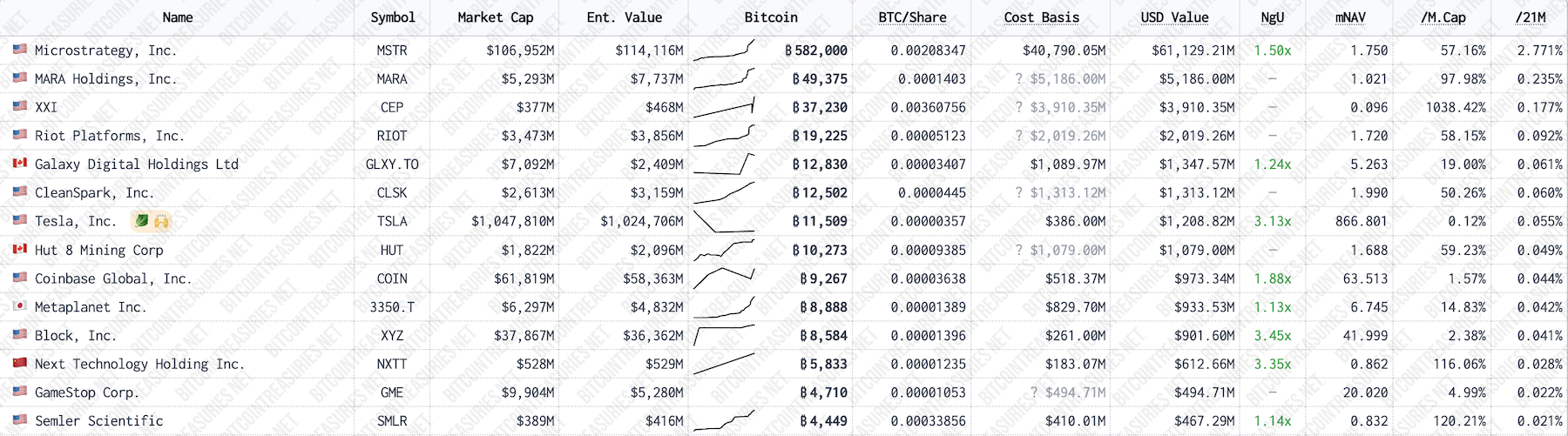

Despite the challenges miners within the highly competitive industry face, some publicly traded Bitcoin mining companies are expanding their operational capacity and choosing to retain their mined BTC as a treasury asset.

Mining firm MARA announced that it increased BTC output by 35% in May, amid a record-level hashrate and market volatility.

On April 5, Bitcoin’s network hashrate crossed 1 zetahash per second (ZH/s) in computing power — a significant milestone for the decentralized monetary protocol.

Despite this, MARA announced that it mined 950 Bitcoin in May and increased its corporate treasury reserves to 49,179 BTC — making it one of the largest Bitcoin holders in the world.

“Record production month for MARA — and we sold zero Bitcoin,” the company’s chief financial officer Salman Khan wrote in a June 3 X post.

CleanSpark, a public Bitcoin miner focused on securing the network through clean energy, also increased its BTC production in May 2025.

The company mined 694 BTC during the month, a 9% increase over production in April, bringing its total reserves to 12,502 BTC, according to its monthly report.

“We increased our month-end hashrate to 45.6 exahashes per second (EH/s), up 7.5% sequentially,” CleanSpark president and CEO Zack Bradford wrote in the May update.

The growing trend of mining companies accumulating Bitcoin as a treasury asset also represents a significant shift in business strategy for mining firms that have traditionally sold their coins to cover operational costs.