Key takeaways:

-

SOL futures open interest is up 12%, signaling strong institutional interest.

-

Spot Solana ETF approval odds jump to 91% on Polymarket.

-

A SOL price bull flag is in play on the weekly chart, targeting $335.

Solana (SOL) price is up 4.3% over the last 24 hours to trade at $165 on Wednesday. This is still 43% below its all-time high of $294, reached on Jan. 19.

However, several fundamental, onchain and technical metrics suggest that SOL could continue its ascent toward new all-time highs above $330.

Solana open interest nears all-time highs

SOL’s Wednesday price increase was accompanied by an uptick in leveraged positions, with the aggregate open interest (OI) for Solana futures reaching $7.54 billion, up 12% in the last 24 hours. This is a 20% increase from the previous week and sits just 12% below the peak of $8.57 billion reached on Jan. 19.

This reflects a strong adoption of SOL derivatives, suggesting rising institutional interest but also introducing potential risks.

Despite the higher risk of forced liquidations in the event of an SOL price correction, derivatives data points to further upside potential.

Rising TVL and number of active Solana addresses

Solana’s primary decentralized application metric started to display strength in April. The network’s total value locked (TVL), which measures the amount deposited in its smart contracts, rose to its highest level since June 2022 at 56.8 million SOL, worth about $9.1 billion.

There are other factors that influence Solana’s increase in value and TVL. To confirm whether DApp use has effectively increased, investors should also analyze the number of active addresses within the ecosystem.

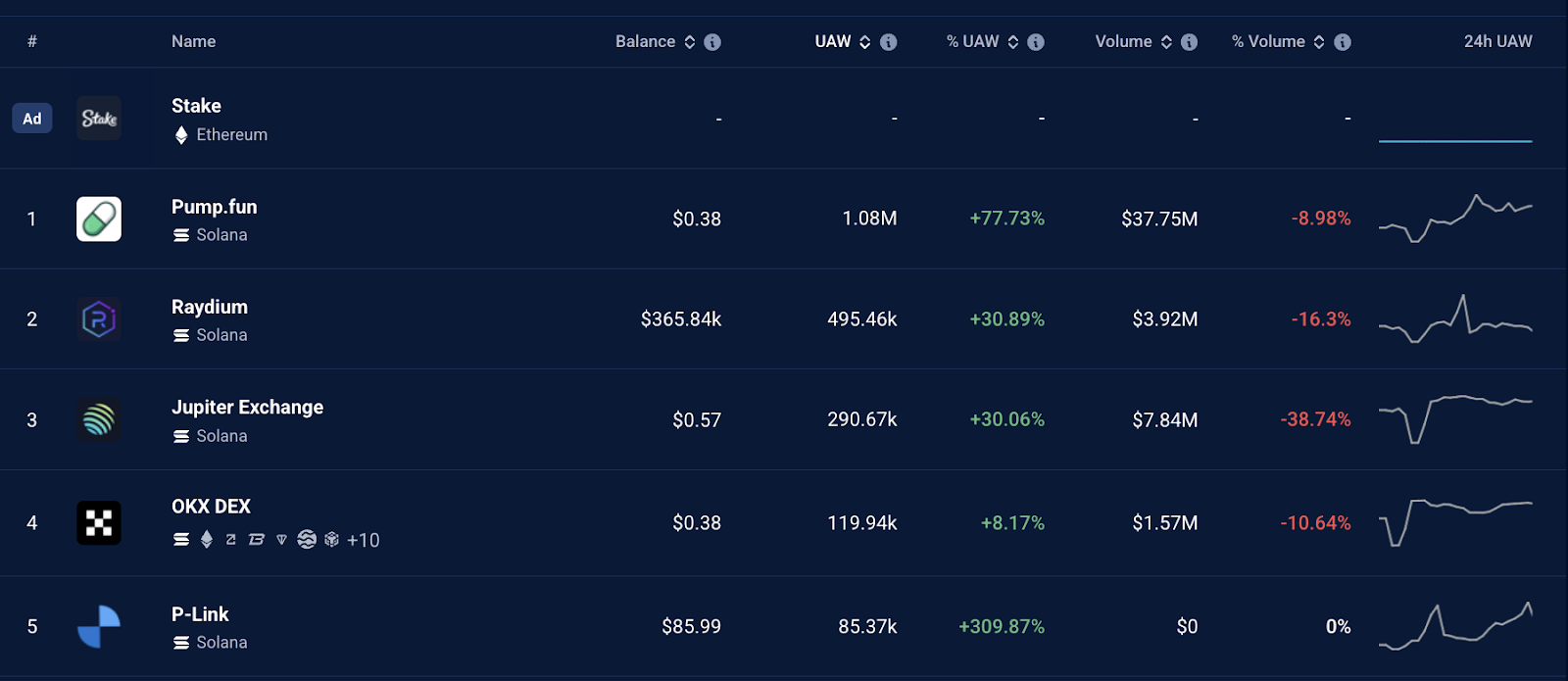

The number of Solana network addresses interacting with decentralized applications jumped by 38.5% over the last 24 hours to 2.7 million. Positive performance is seen among the top five DApps, with their unique active wallets (UAWs) rising by 77%-300% as shown in the chart below.

This suggests increased interest in the layer-1 ecosystem, lifting demand for SOL.

Solana ETF approval odds jump to 91%

The likelihood of the US Securities and Exchange Commission (SEC) approving a spot Solana exchange-traded fund (ETF) in 2025 jumped to 91% Wednesday, according to Polymarket data.

Multiple spot Solana ETF applications from asset management giants like VanEck, Grayscale, 21Shares, Bitwise and Canary Capital signal robust demand for regulated SOL investment vehicles.

Related: Société Générale launches US dollar stablecoin on Ethereum and Solana

Bloomberg senior ETF analyst Eric Balchunas said the SEC could “act early” on Solana and staking ETF filings, placing the approval odds at 90%.

“Get ready for a potential Alt Coin ETF Summer with Solana likely leading the way.”

Get ready for a potential Alt Coin ETF Summer with Solana likely leading the way (as well as some basket products) via @JSeyff note this morning which includes fresh odds for all the spot ETFs. pic.twitter.com/UMzih4oou7

— Eric Balchunas (@EricBalchunas) June 10, 2025

Approval of these funds could unlock institutional capital, amplify demand for SOL and potentially drive prices higher, with some analysts predicting targets as high as $1,300.

SOL price bull-flag hints at $335

SOL price has formed a bull flag chart pattern on the weekly chart, as shown below.

A bull flag pattern is a bullish setup that forms after the price consolidates inside a down-sloping range following a sharp price rise.

Bull flags typically resolve after the price breaks above the upper trendline and rise by as much as the previous uptrend’s height. This puts the upper target for SOL price at $335, or a 103% increase from the current price.

The weekly RSI is moving above the midline and has increased to 51 this week from 36 on March 31, indicating increasing bullish momentum.

Cointelegraph reported that the SOL/USD pair must first flip the resistance at $190 into new support to ensure a sustained recovery.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.