US investment manager Guggenheim is expanding its digital commercial paper offering through a partnership with Ripple, underscoring the growing convergence between traditional finance and crypto-native enterprises.

Under the partnership, Guggenheim’s subsidiary, Guggenheim Treasury Services, will make its US Treasury-backed fixed-income asset available on the XRP Ledger, according to Bloomberg. Ripple will invest $10 million in the asset as part of the collaboration.

The commercial paper product is fully backed by US Treasurys with customized maturity options of up to 397 days.

RippleX executive Markus Infanger told Bloomberg that the product could also be made available for purchase using Ripple’s US dollar-pegged stablecoin, RLUSD. Since its launch in December, RLUSD’s circulating supply has surpassed $350 million.

The Ripple partnership isn’t Guggenheim’s first foray into the cryptocurrency sector. As previously reported by Cointelegraph, Guggenheim tokenized its $20 million commercial paper offering on the Ethereum blockchain in September 2024.

Related: Dubai regulator greenlights Ripple’s RLUSD stablecoin

Wall Street eyes RWA tokenization

Tokenization is rapidly gaining momentum on Wall Street, as leading financial institutions recognize the benefits of enabling real-world assets (RWAs) to be traded onchain.

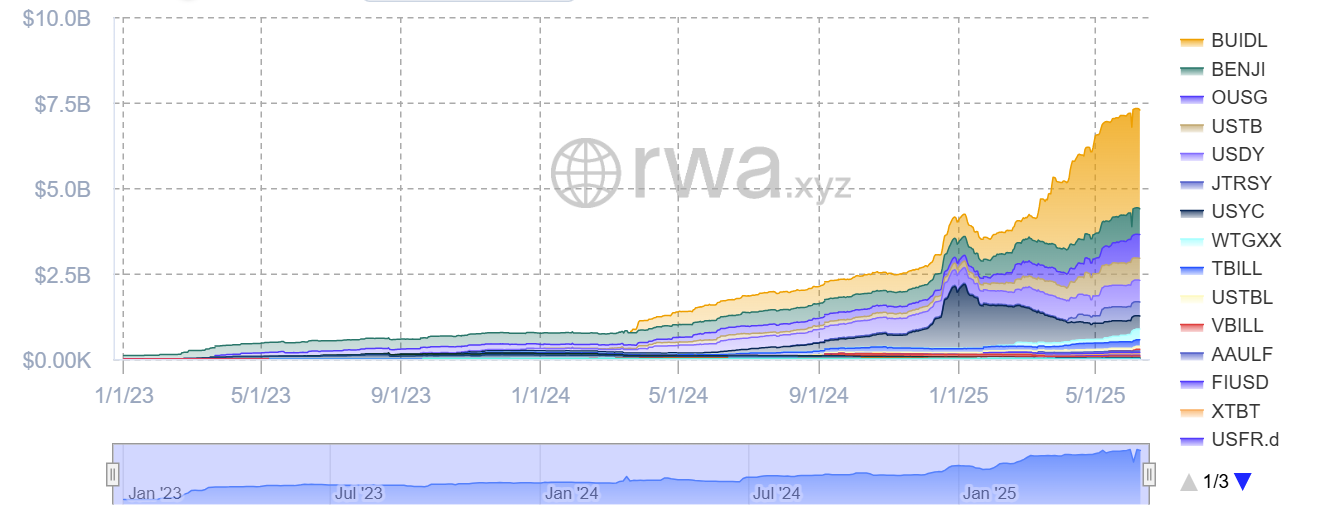

Among the most notable trends is the tokenization of money market funds, exemplified by BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), Franklin Templeton’s OnChain US Government Money Fund, and Fidelity’s tokenized US dollar money market fund.

Crypto-native companies are also broadening access to tokenized assets for a wider investor base.

As Cointelegraph reported, German tokenization protocol Midas recently launched a tokenized Treasury bill on the Algorand blockchain. Unlike BUIDL, which requires a minimum investment of $5 million, Midas’ product has no investment minimums, making it accessible to more investors.

Meanwhile, blockchain-focused venture firm Jump Crypto recently made an undisclosed investment into Securitize, the tokenization platform behind BlackRock’s BUIDL.

Securitize has accumulated more than $4 billion in onchain assets, with BUIDL accounting for nearly $3 billion.

Related: BlackRock ‘BUIDL’ tokenized fund triples in 3 weeks as Bitcoin stalls