Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s price shook off last week’s dip and climbed sharply on Tuesday morning in Asia, topping $110,000 briefly before settling around $109,450. Traders rushed back in after the asset dipped close to $100,000, feeding a sharp rebound that leaves Bitcoin just 2.8% shy of its record high.

A blend of forced liquidations, surging derivatives volume, easing US–China trade tensions and steady on-chain withdrawals is driving the move.

Related Reading

Heavy Liquidations Shift The Balance

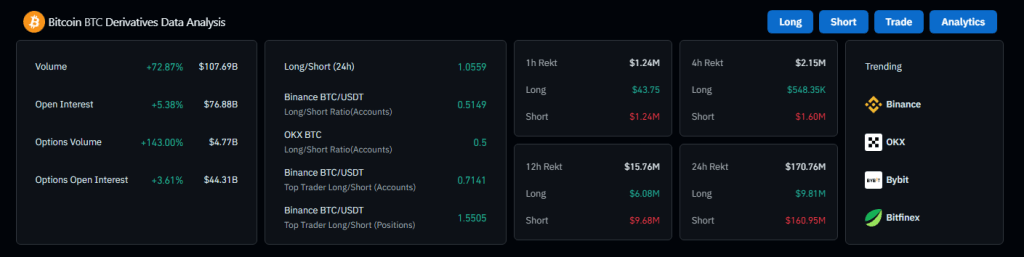

According to Coinglass, nearly $203 million in Bitcoin positions were wiped out over the past 24 hours. Of that, $195 million were against shorts. When so many short bets unwind at once, it forces buyers to cover positions, which can send prices spiking. Yet history shows these “short squeezes” can reverse quickly when traders take profits.

Based on reports, Bitcoin’s derivatives volume more than doubled, climbing over 110% to $110 billion. Open interest then followed suit, expanding 7.3% to almost $77 billion.

These kinds of inflows indicate that new money is accumulating. Both open interest and volume rising tends to indicate enthusiasm—and a willingness to carry through positions with swings.

Trade Diplomacy Lifts Risk Assets

Talks resumed in London on June 9 between the US and China over tariffs and export rules. Even a hint of progress tends to boost appetite for riskier assets, and Bitcoin isn’t immune.

Headlines of smoother trade ties lifted equities earlier this week—and crypto traders moved in tandem. If negotiations hit a snag, though, Bitcoin could slide with global markets.

On-Chain Data Shows Steady Accumulation

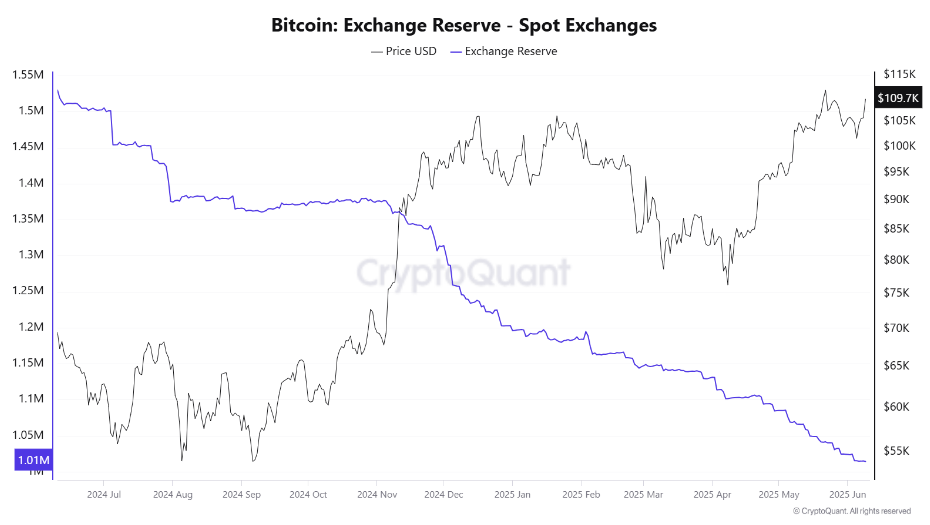

CryptoQuant’s numbers reveal that centralized exchanges have shed 550,000 BTC since July 2024, falling from 1.55 million to about 1.01 million today. As coins leave exchanges, float tightens. At the same time, the Coinbase Premium indicator rose, with US buyers paying more than overseas investors.

Santiment also reports renewed accumulation among wallets holding 10–100 BTC. This pattern hints at long-term holding rather than quick trades.

Related Reading

Correlation And Caution Remain

When you consider the rally, Bitcoin still dances on the tunes of equity price swings. Futures have mixed bets between bulls and bears, showing portrait-wise signs that certainly not everybody is convinced this run is going to hold.

High volatility would tend to wash out weak hands at the slightest hint of trouble, any reversal of risk sentiment, or a sudden macro shock would cost the rally dearly.

Optimism is building as analysts talk of fresh all-time highs. Some even eye $150,000 by the end of the year if US debt levels climb further. But sustaining a rally of that magnitude will require more than forced liquidations.

Traders will watch derivatives flows, on-chain reserves and trade headlines for signs of real, lasting demand before pushing prices much higher.

Featured image from Imagen, chart from TradingView