Bitcoin has resumed its upward trajectory, registering a modest 1.6% gain over the last 24 hours to trade at $107,428. The recovery comes after last week’s dip toward $100,000 levels, which had been triggered by market-wide volatility and profit-taking.

While BTC remains approximately 4.2% below its all-time high of $111,000 reached last month, the weekly trend still reflects a 3.3% increase, suggesting buyers are gradually regaining confidence. This market behavior is mirrored in a set of on-chain indicators recently analyzed by CryptoQuant contributor Amr Taha.

Bitcoin On-Chain Metrics Reflect Accumulation Behavior

In Taha’s analysis titled “On-Chain Data Hints at Bitcoin’s Next Leg Higher,” Taha examined several metrics that point to a potential continuation of the rally.

These include the Binance Taker Buy/Sell Ratio, UTXO age bands, and the Long-Term Holder (LTH) realized cap. All three suggest that market participants are actively accumulating and that underlying sentiment is shifting toward renewed bullishness.

One of the primary indicators Taha focused on is Binance’s Taker Buy/Sell Ratio, which has recently climbed to 1.1. This metric evaluates the volume of aggressive market buys versus market sells on the Binance exchange.

A ratio above 1 typically implies that more participants are willing to pay the market price to buy than to sell, indicating stronger buyer conviction. According to Taha, such shifts historically precede continued price increases when supported by volume.

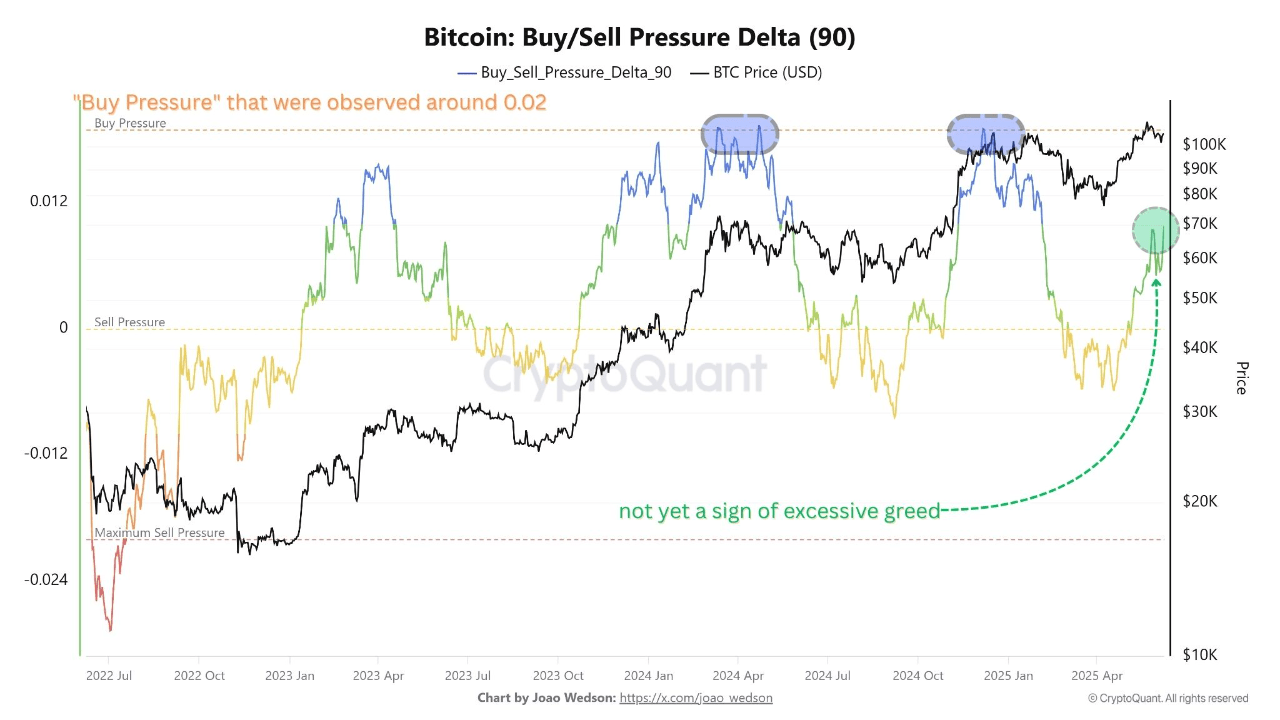

Another key metric showing strength is the Buy/Sell Pressure Delta over the last 90 days. This indicator tracks the net difference between buying and selling pressure and is now halfway to its historical peak at 0.02.

Taha explains that this suggests a market not yet overheated, with room for further accumulation. Combined with recent breakout behavior above the 1D–1W UTXO band, representing recently transacted coins, this hints that many new holders are currently in profit and choosing to hold rather than sell.

LTH Conviction and Stablecoin Inflows Reinforce Bullish Case

Taha also noted the Long-Term Holder (LTH) Realized Cap has now surpassed $56 billion, reflecting strong hands holding a larger share of Bitcoin supply. These coins have not moved in over 155 days and are considered to represent investors with higher conviction.

The increase in this metric implies that fewer coins are being sold into the market, a signal that many investors are expecting higher valuations in the coming weeks or months.

In addition, more than $550 million in stablecoins have reportedly flowed into Binance in recent hours. Historically, such inflows to spot exchanges, as opposed to derivatives platforms, often suggest readiness to deploy capital for direct asset purchases.

Notably, all of these indicators can be seen as a leading signal of potential volatility or buying pressure. If this pattern holds, Bitcoin’s short-term price activity may benefit from continued accumulation and institutional positioning.

Featured image created with DALL-E, Chart from TradingView