Bitcoin (BTC) dropped sharply over the past 24 hours, nearing the $100,000 mark with an intraday low of $100,984. This price movement reflects increased volatility across the crypto market following a public exchange on social media between US President Donald Trump and Tesla CEO Elon Musk.

Their clash appears to have triggered a wave of risk-off sentiment among traders. In response, the global crypto market cap slipped 4%, falling from over $3.4 trillion yesterday to $3.33 trillion. Meanwhile, the broader market correction has not gone unnoticed in derivatives data.

Derivative Metrics Reveal Bearish Sentiment Spike

According to CryptoQuant analyst Darkfost, the Binance net taker volume, a metric that measures the difference between aggressive longs and shorts, fell dramatically from $20 million to -$135 million in under eight hours.

This signals a sharp pivot in sentiment, as traders rushed to hedge or speculate on downside risk in response to the unfolding news.

Darkfost emphasized that this was the largest intraday net taker volume reversal observed on Binance this year. The abrupt shift reflects how quickly sentiment can change when macro-level narratives or influential figures dominate headlines.

In this case, the market responded swiftly to perceived uncertainty, leading to a concentration of short positions and significant selling pressure.

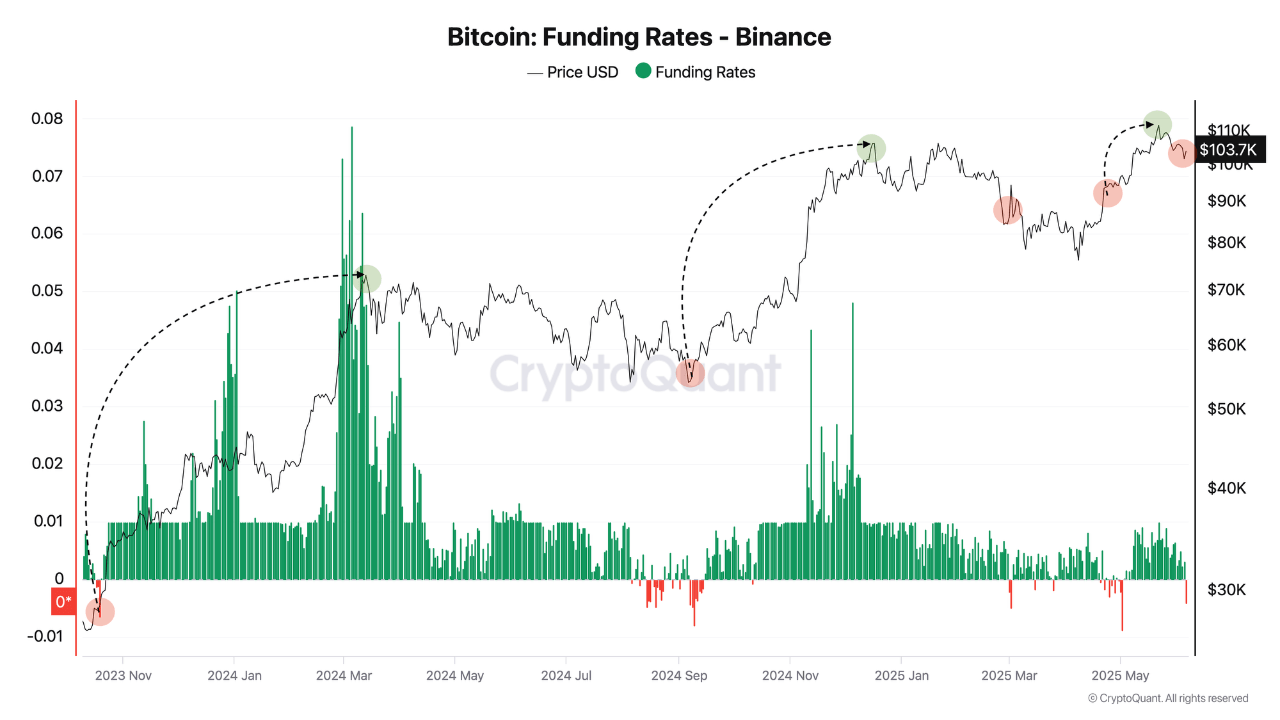

The situation also led to a notable change in BTC perpetual futures funding rates. Funding on Binance turned negative after briefly trending toward positive territory, dropping from +0.003 to below -0.004.

This indicates that short sellers were willing to pay a premium to maintain bearish positions, underscoring rising fear and potentially overextended downside bets.

When Funding rates turns negative.

Buying or considering a long position is often wise when funding rates turn highly negative, especially if the price starts to trend upward.

This typically signals a disbelief sentiment among traders, creating strong contrarian… pic.twitter.com/LGyHU9uNNK— Darkfost (@Darkfost_Coc) June 6, 2025

Bitcoin Past Patterns Suggest Potential for Reversal

Historically, deeply negative funding rates have been followed by strong recoveries in Bitcoin’s price. Darkfost noted three previous events where similar funding shifts led to large rallies: October 2023 (BTC surged from $28,000 to $73,000), September 2024 (from $57,000 to $108,000), and May 2025 (from $97,000 to $111,000).

While not guaranteed, these patterns suggest that extreme pessimism can sometimes signal market turning points. The only recent exception occurred in March 2025 following trade tariff announcements, which led to a continued decline.

Still, many traders are watching closely for signs of a short squeeze, where price rebounds force short sellers to cover, amplifying upward momentum.

Featured image created with DALL-E, Chart from TreadingView