- Abraxas Capital’s short positions on BTC, ETH, SOL, HYPE, and SUI were in a floating profit over $55M.

- The weekly candles showed weakness but holding the $3 zone was critical for a bounce back.

Abraxas Capital seized the chance provided by the cryptocurrency decline to amass profits from shorting on Bitcoin [BTC], Ethereum [ETH], Solana [SOL], Hyperliquid [HYPE] and Sui Network [SUI] on the HyperLiquid exchange, as OnChain Lens noted.

It was clear from these trades involving two wallets that the firm was expecting a steep drop in major assets.

Relative to SUI, this short interest led to a decrease in its price. This could have stemmed from the general market sentiment and short sellers using borrowed capital.

Is SUI in a pullback or breakdown?

On that note, as the price dropped to $3.00, SUI faced a key challenge that could help protect the gains or spark a rebound.

Signs of wobbling appeared, which hinted that bulls were waiting before making a move. Should SUI reverse from $3, it could retake $4 then return to test its top at $5.36.

If $3.00 holds, price could rebound toward $3.90 and eventually retest $5.36, its recent high.

However, failure to defend this area could drag SUI toward the $2.00 zone or the $1.38–$1.50 range, both of which have served as historical support in March and April.

The histogram of the MACD remained green and positive, which meant that momentum was not entirely turning bearish.

A break of higher lows in the price structure made it possible that SUI could be forming a wider pattern of negativity.

If the $3 level holds, a bounce could make the market go as high as $3.90 or even $5 after a while.

However, if bearish trends continued, SUI could be unable to hold above key support levels, creating even more extreme drops.

But if the SUI market normalized and shorts began covering, that would create a swift and strong surge.

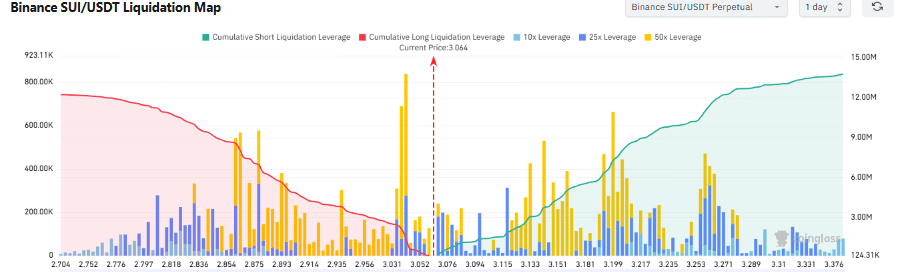

Liquidations leaning on sell-side

More importantly, the liquidation map shows traders heavily positioned on the sell side. Roughly $13.78 million in short liquidations remain vulnerable if the price climbs into the $3.39 cluster.

This cluster, between $3.05 and $3.39, is loaded with 10x, 25x, and 50x levered positions. A move past $3.06 could trigger a cascade of liquidations, forcing short sellers to exit.

At the same time, a buildup of cumulative long positions sits just below $3.06, especially between $2.70 and $2.95. This setup presents a dual risk—if price surges, shorts get squeezed; if it drops, longs may rush to exit.

Moreover, selling pressure from those who had gone long on SUI could cause the market to sell off even more as they look to cut losses or take profits.

Despite there being two main groups, it showed that most people were betting on lower prices.